Fair Lending Analysis That Easy to Understand

New Regression Ntelligence spots lending bias in minutes. Zero statistical expertise needed.

Fair Lending Compliance Software

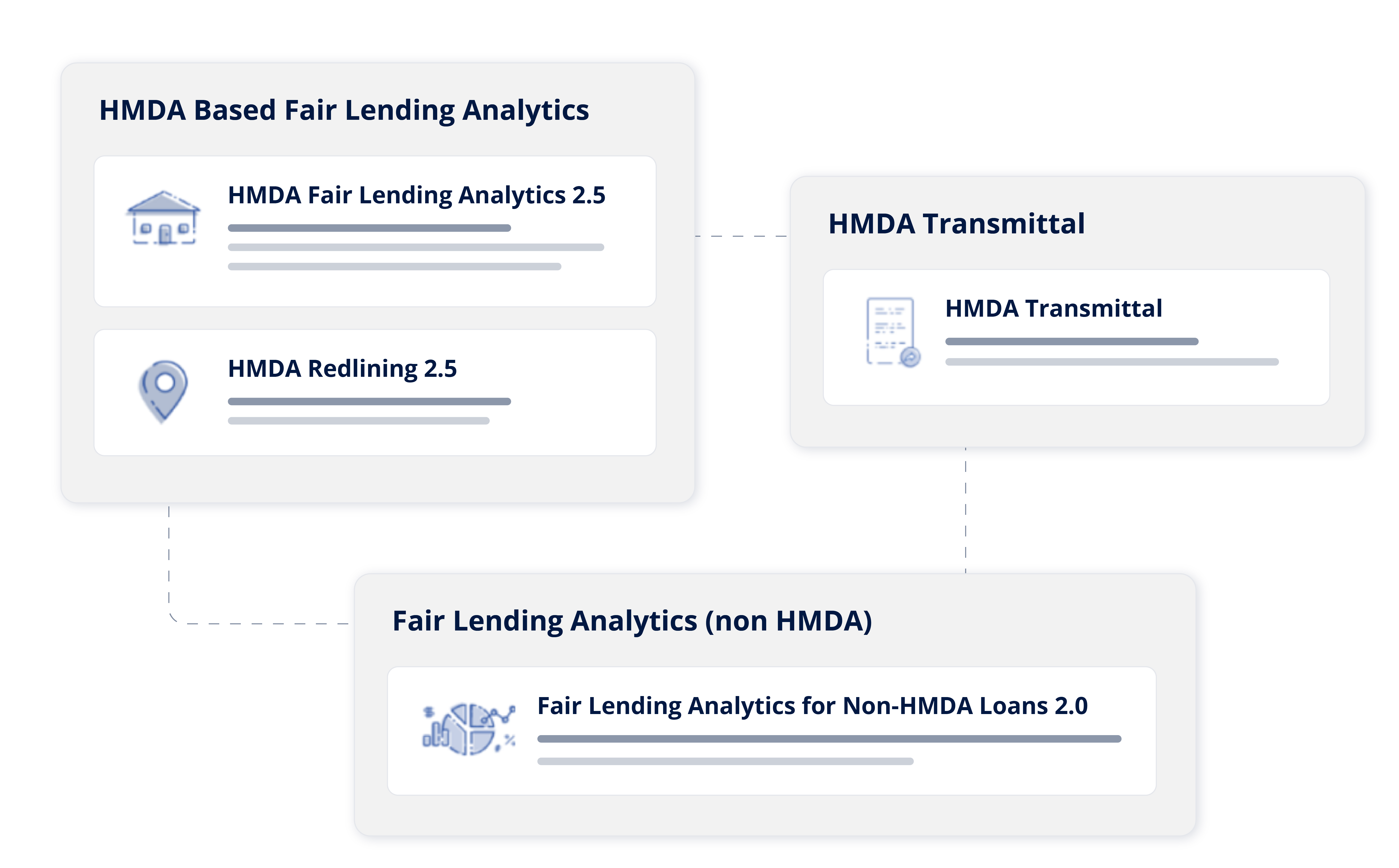

Build your perfect fair lending analysis software bundle with Nlending. Manage every aspect of fair lending compliance — from transmittals, analytics and tracking to geocoding, mapping and AI-powered regression analysis. Choose from HMDA, consumer, and CRA tools.

Fair lending software trusted by financial institutions from coast to coast

Tools for Mastering Lending Compliance

Nlending gives lenders the compliance management tools they need to help ensure compliance with data reporting for HMDA, CRA and 1071. From data scrubbing and transmittal to sophisticated analytics and expert support, our fair lending program has lenders covered – whether you are a lending compliance beginner or a seasoned pro.

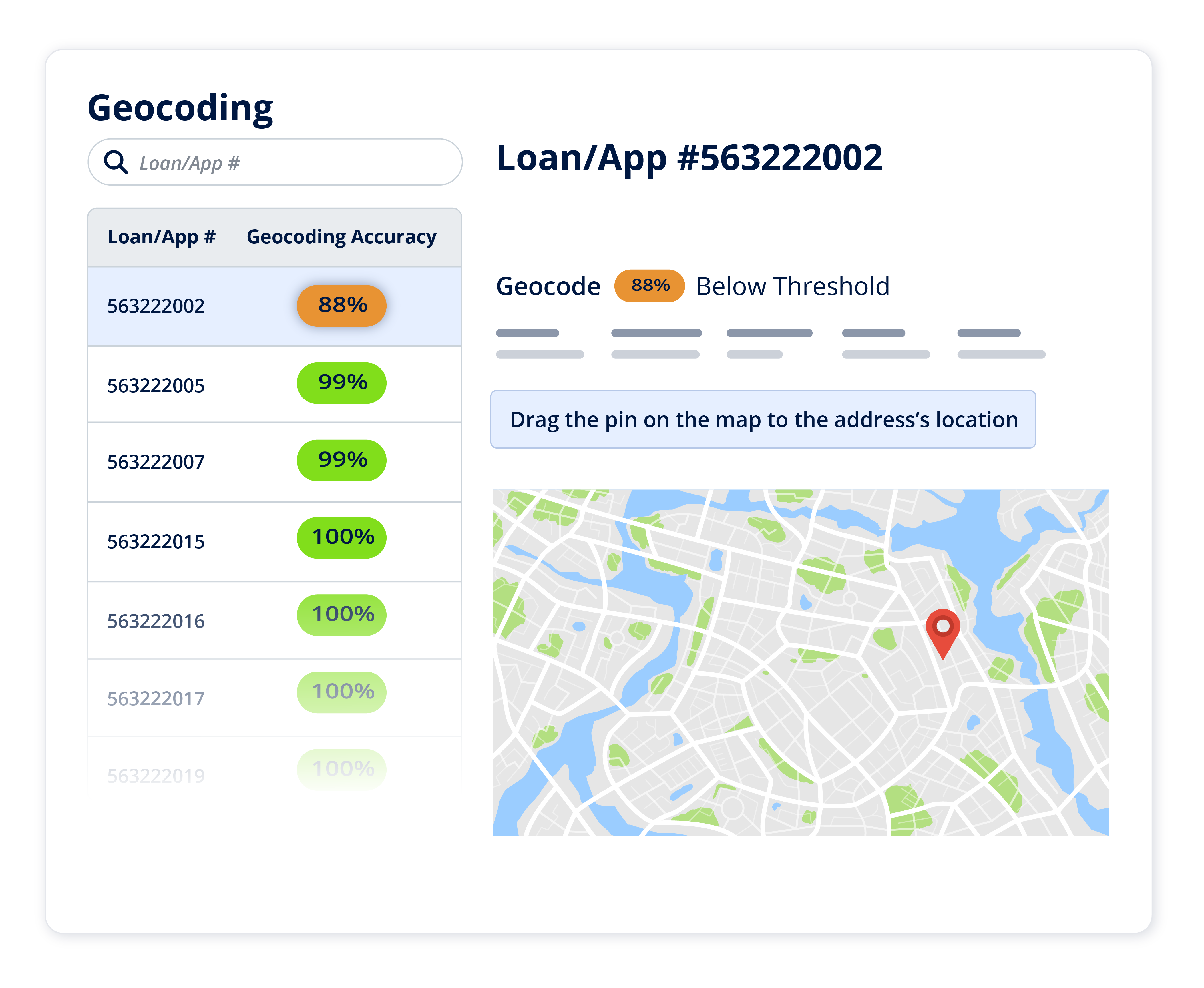

Mapping and Geocoding

Batch, single search, or integrated LOS geocode for the highest available level of street matching (99.5%) with GPS quality street data. Analyze applications, loans and deposits via interactive mapping (includes tract income and minority, roadways, census tracts, zip codes, etc.)

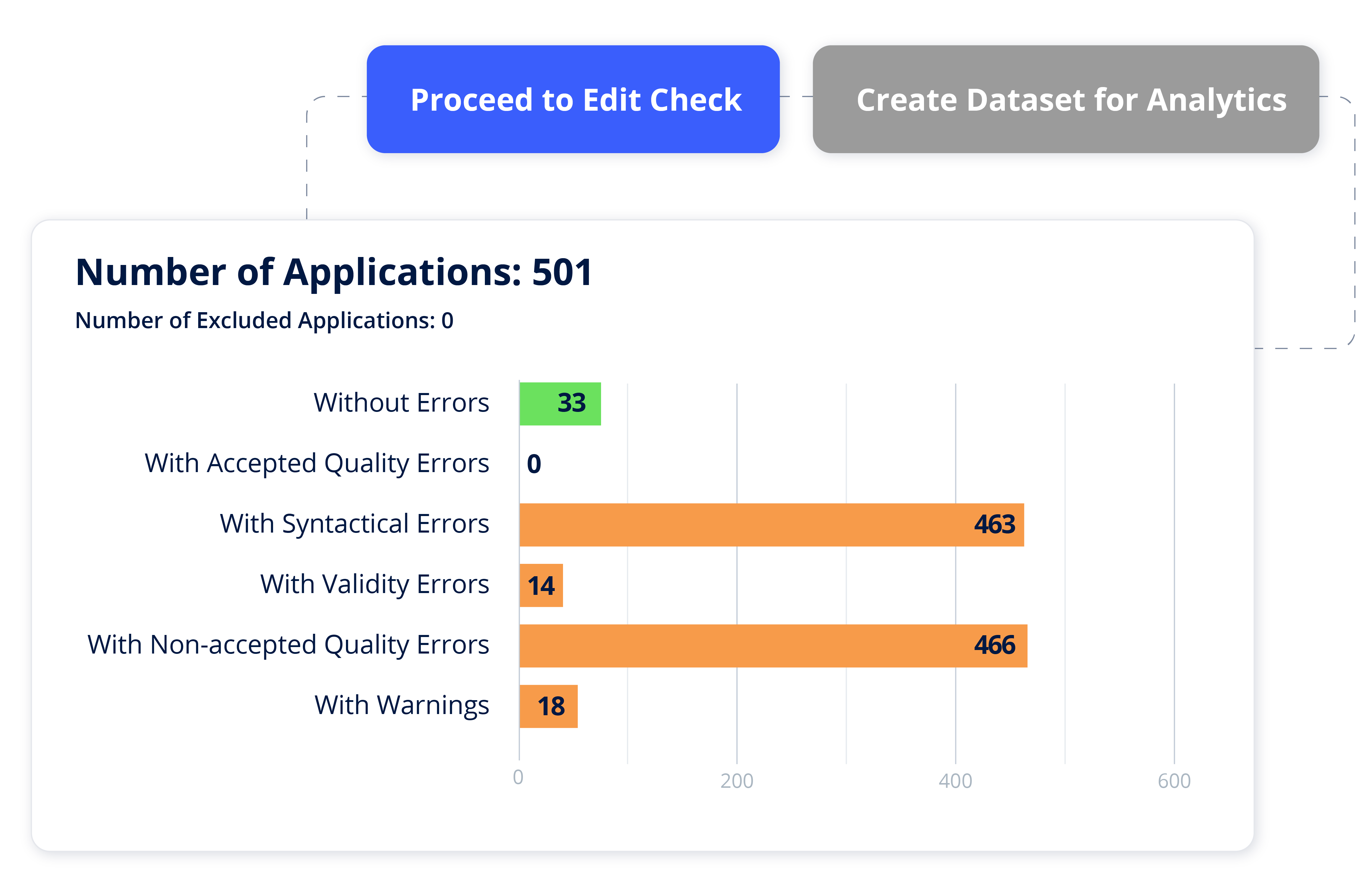

Error Identification

Dozens of data fields make combing through HMDA, CRA, and 1071 LARs to identify discrepancies time consuming and tedious. Our fair lending compliance software identifies potential data errors – such as geocoding that doesn’t match or an address doesn’t exist – and allows lenders to correct them prior to submission.

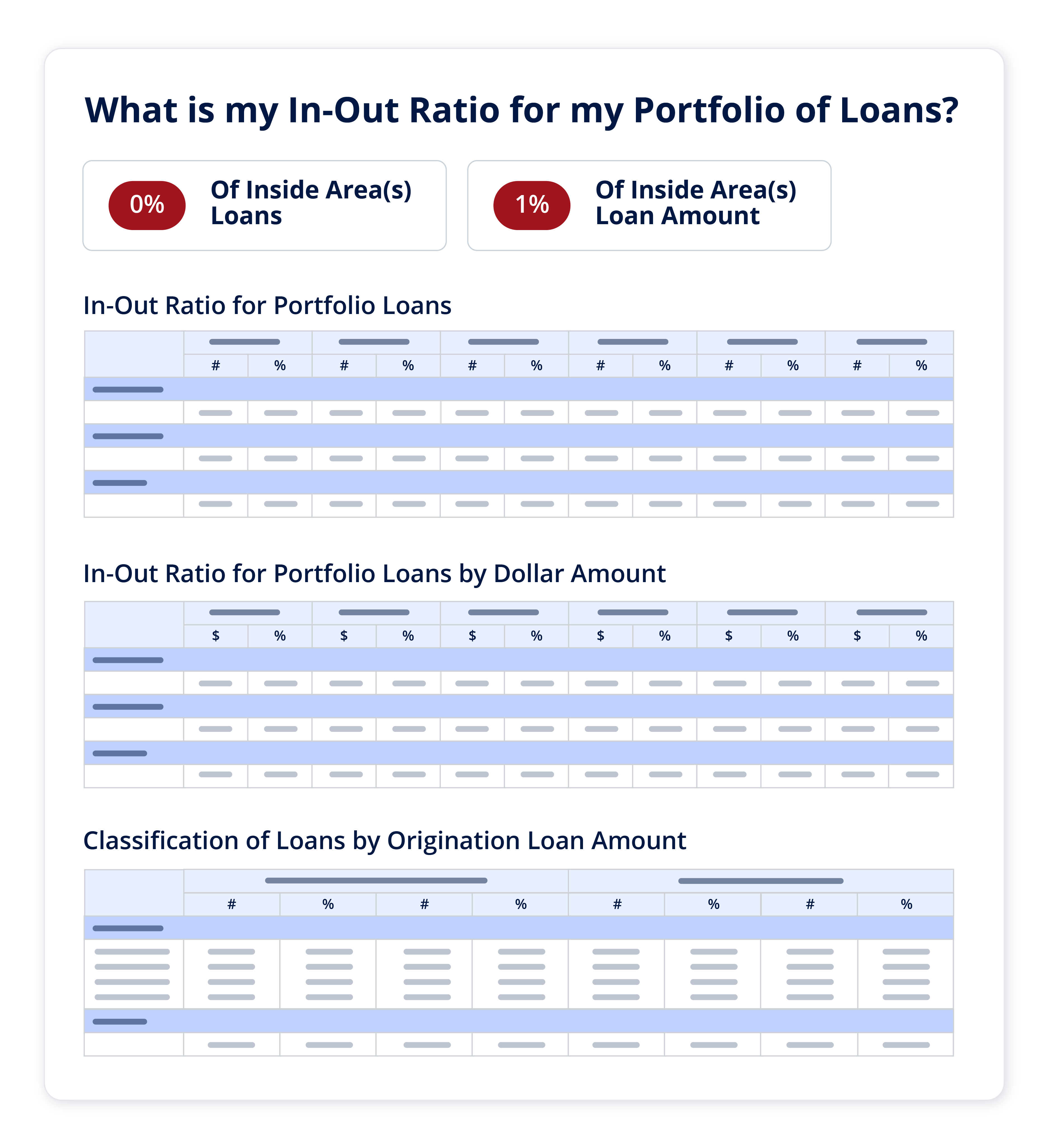

Exam-Ready Reporting

Pre-built reporting templates quickly generate management-ready reports, including parity to peer, redlining and lending decision reports plus data analysis and matched pair reports.

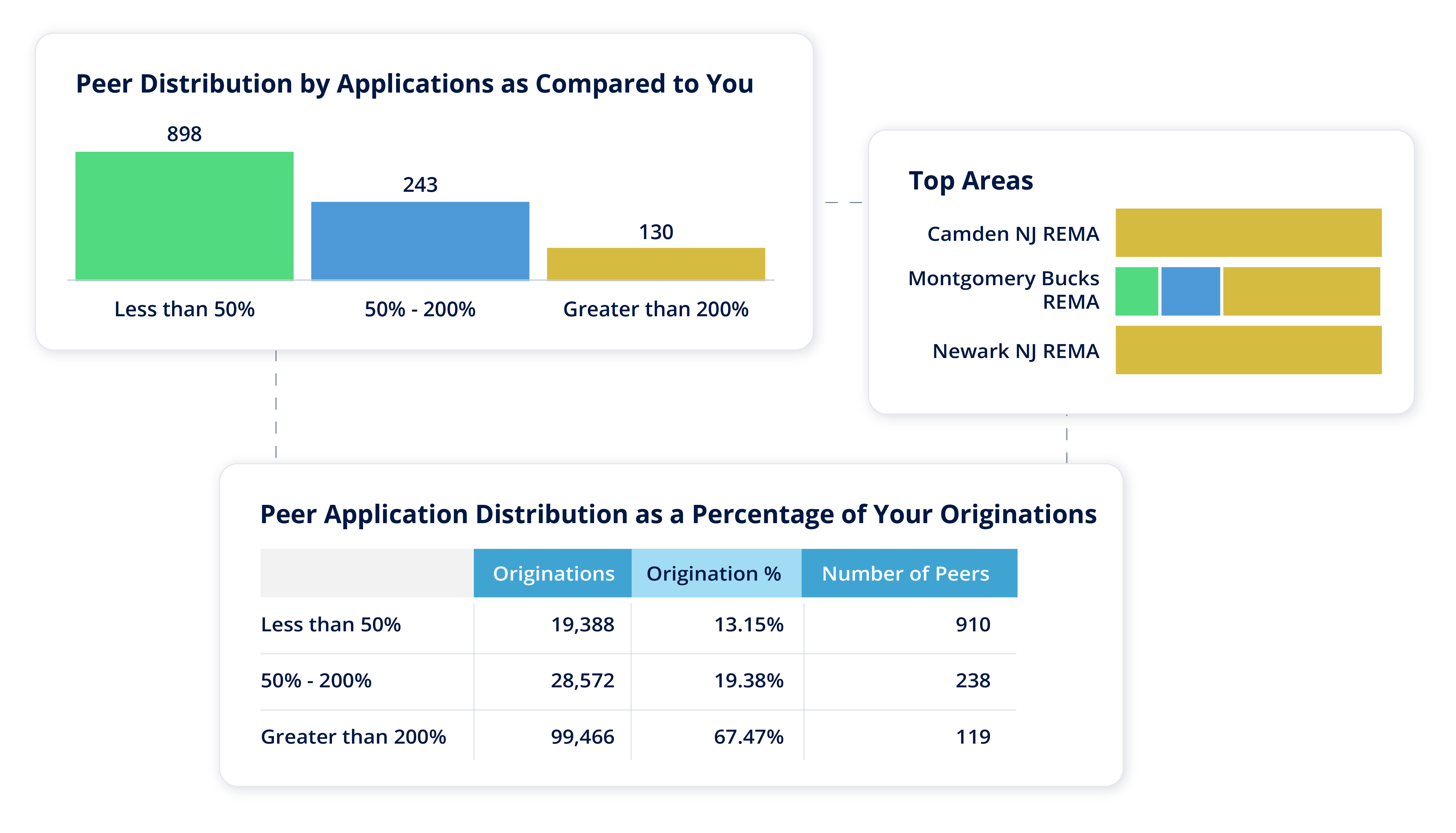

Peer Benchmark Analysis

Benchmark analysis enables you to compare your lending to peer institutions in your analysis and/or assessment area REMA.

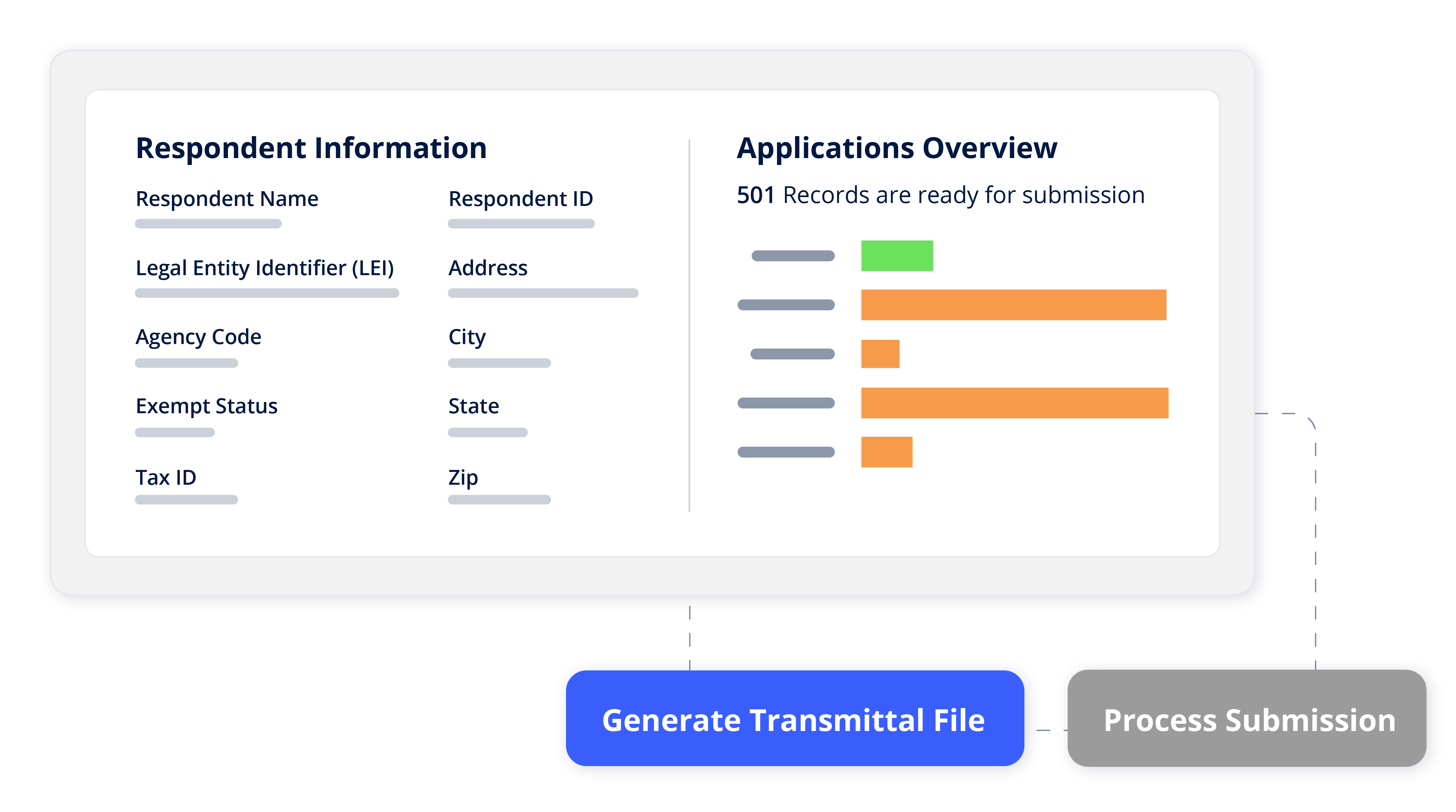

Lending Data Transmittal

Format and file applications and loans in compliance with regulatory requirements. Capture application and loan data for transmittal files.

Interactive Data Visualization

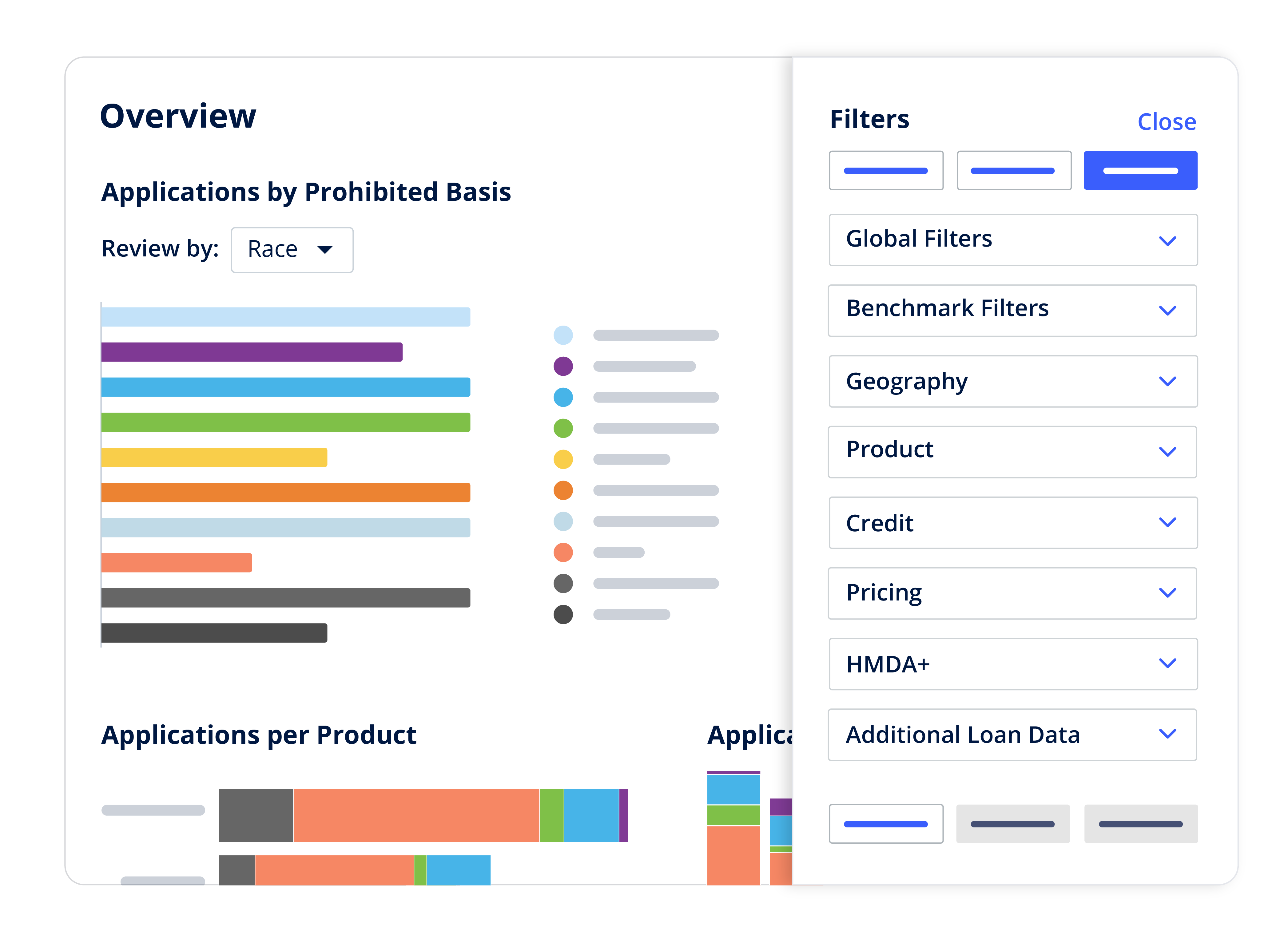

Interactive results panels permit users to adjust parameters, make notations, and interact with the data.

Sophisticated Lending Analytics

Analyze your data by applying filters to narrow results and identify emerging risks. Perform comparative reviews, highlight disparities, and select matched pairs and target and control groups.

Single sign on (SSO) access and dashboard interface

Administrative control of authorizations and access levels

Proxy assignment methodology for consumer lending analysis

Ability to import a variety of data via data mapping tool

Pre-loaded market data (Census, HMDA and CRA)

In-app storage and access to individual loan records

Notation recording capabilities

Automated geocoding

Expert guidance

Flexible Fair Lending Software

Nlending gives lenders the tools they need report data, identify potential discrimination, and comply with fair lending laws. From data scrubbing and transmittal to sophisticated analytics and expert support, Nlending has you covered.

Proxy assignment methodology for consumer lending analysis

Pre-loaded market data (Census, HDMA, and CRA)

Administrative control of authorizations and access levels

Notation recording capabilities

In-app storage and access to individual loan records

Ability to import a variety of data

Expert guidance

Single sign on (SSO) access

Automated geocoding

Fair Lending Analysis Software Benefits

Nlending delivers the clarity and proof you need to stand behind your fair lending performance with confidence.

Avoid compliance violations

Minimize errors in the collection and analysis of small business data.

Identify disparities

Uncover and investigate potential discrimination.

Enjoy Exam-Ready Reporting

Easily explain your loan data to examiners.

Better Serve Your Community

Ensure local credit needs are met.

Ready to Transform Your Lending Compliance?

Connect with a team of experts on the benefits of our fair lending solutions. Cut quarterly analytics workload from 96 hours to as little as 3 hours.

Customer Success Story

Imagine cutting the time spent analyzing and reporting loan data from days to mere hours – while significantly reducing fair lending risk. Oklahoma-based Valliance Bank did that with Nlending. Read how.

Frequently Asked Questions

A fair lending program is the formal framework a lender uses to ensure that all applicants and borrowers are treated fairly — with no discrimination based on race, ethnicity, gender, age, or other protected characteristics — across every stage of the credit lifecycle.

It typically includes policies and procedures, risk assessments, ongoing monitoring (including statistical analysis), training, and reporting.

The goal isn’t just legal compliance — it’s proactively detecting, preventing, and correcting potential bias before it causes consumer harm.

Fair lending analysis is the process of reviewing lending data, decisions, and outcomes to detect potential discrimination or disparities that could harm protected classes.

Advanced fair lending analysis often involves statistical testing, regression modeling, matched pair reviews, comparative file analysis, or trend monitoring over time — all with the goal of determining whether disparities exist and whether they can be explained by legitimate credit factors.

In short: fair lending analysis is the evidence-based testing that proves your lending decisions are fair — or helps you fix them before regulators do.

Fair analysis is deep, data-driven testing to detect disparities — often using statistical models or matched-pair reviews.

Fair lending monitoring is ongoing, proactive oversight — tracking trends, exception activity, complaints, and early warning signals. Monitoring is about staying ahead; analysis is about proving what’s already happened.

Fair Lending Regression Analysis: Are You Ready?

Find the real story in your lending data. Learn the goals, inputs, and outlier checks that matter.

The Fair Lending Analytics Buyer’s Guide

Learn about the key components to look for in a modern fair lending analytics solution.

7 Essential Fair Lending Risks

Fair Lending compliance can be complex - but a clear understanding of your risk can make it much simpler.