Expert TPRM Evaluation

Let our experts evaluate your third-party vendor management policy to help you:

- Align with regulatory expectations

- Identify areas for improvement

- Reduce risk exposure

- Build a more resilient third-party ecosystem

Risk management solutions trusted by thousands of financial institutions across the country

Schedule your evaluation with our experts today!

Vendor Management Buyer's Guide

This buyer's guide will explain what to look for when selecting a vendor management system for your financial institution.

Third-Party Service Providers and Vendor Management

This new vendor management guidance from the federal regulatory agencies aligns requirements among the OCC, FDIC, and the Federal Reserve and replaces existing guidance.

Third-party risk management evaluation.

First-class results.

Our Third Party Risk Management Program Evaluation is specifically tailored to meet the needs of banks, and it includes:

Regulatory Compliance and Best Practices

Our program evaluation not only helps your bank achieve and maintain compliance with regulatory requirements but also fosters good business practices that contribute to a stronger return on investment in your third-party relationships.

Identification of Content Gaps

We thoroughly assess your existing risk management program and identify any areas where content may be lacking or insufficient, potentially exposing your bank to unnecessary risks.

Recommendations for Strengthening Content

Based on industry best practices and the latest Interagency Guidance, we provide you with practical and actionable recommendations to enhance the strength and effectiveness of your risk management program.

Vendor's Keeper: How to Make Sure Your Third-Party Vendors Aren’t Creating a Compliance Nightmare

This whitepaper will explore the overlap between compliance and vendor management, offering strategies and best practices for mitigating the compliance risk of third-party vendors.

%20(1).png?width=1019&height=809&name=Copy%20of%20Various%20Clients%20%20Social%20Images%20(4)%20(1).png)

Risks are constantly evolving.

You deserve a solution that can keep up.

Nvendor solutions and services work together for integrated, effective vendor management. Our team includes lawyers, former financial institution risk officers, and compliance officers to help mitigate third-party risk for your organization.

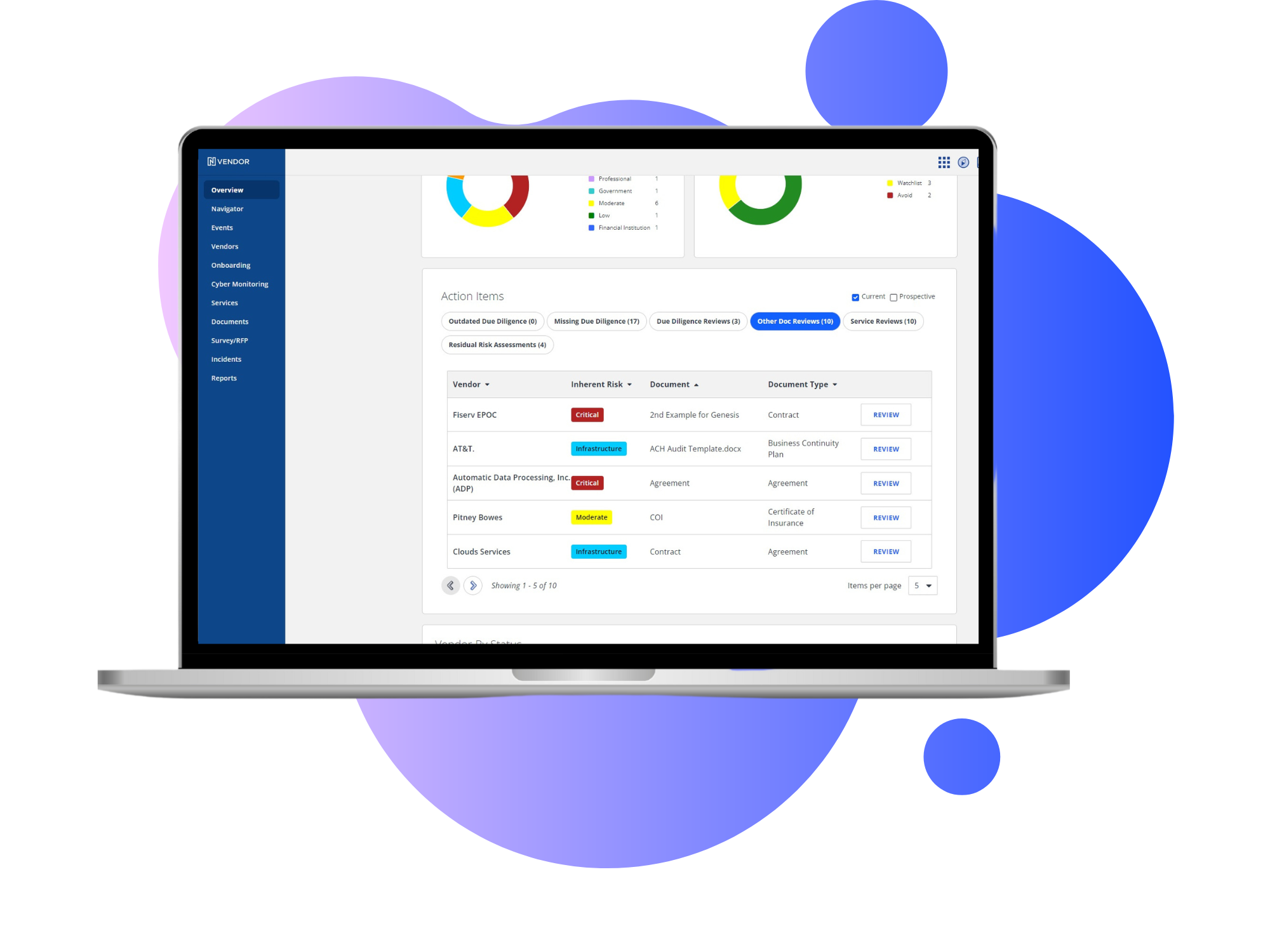

With Nvendor, you gain access to premium features and tools like:

Streamlined Vendor Lifecycle

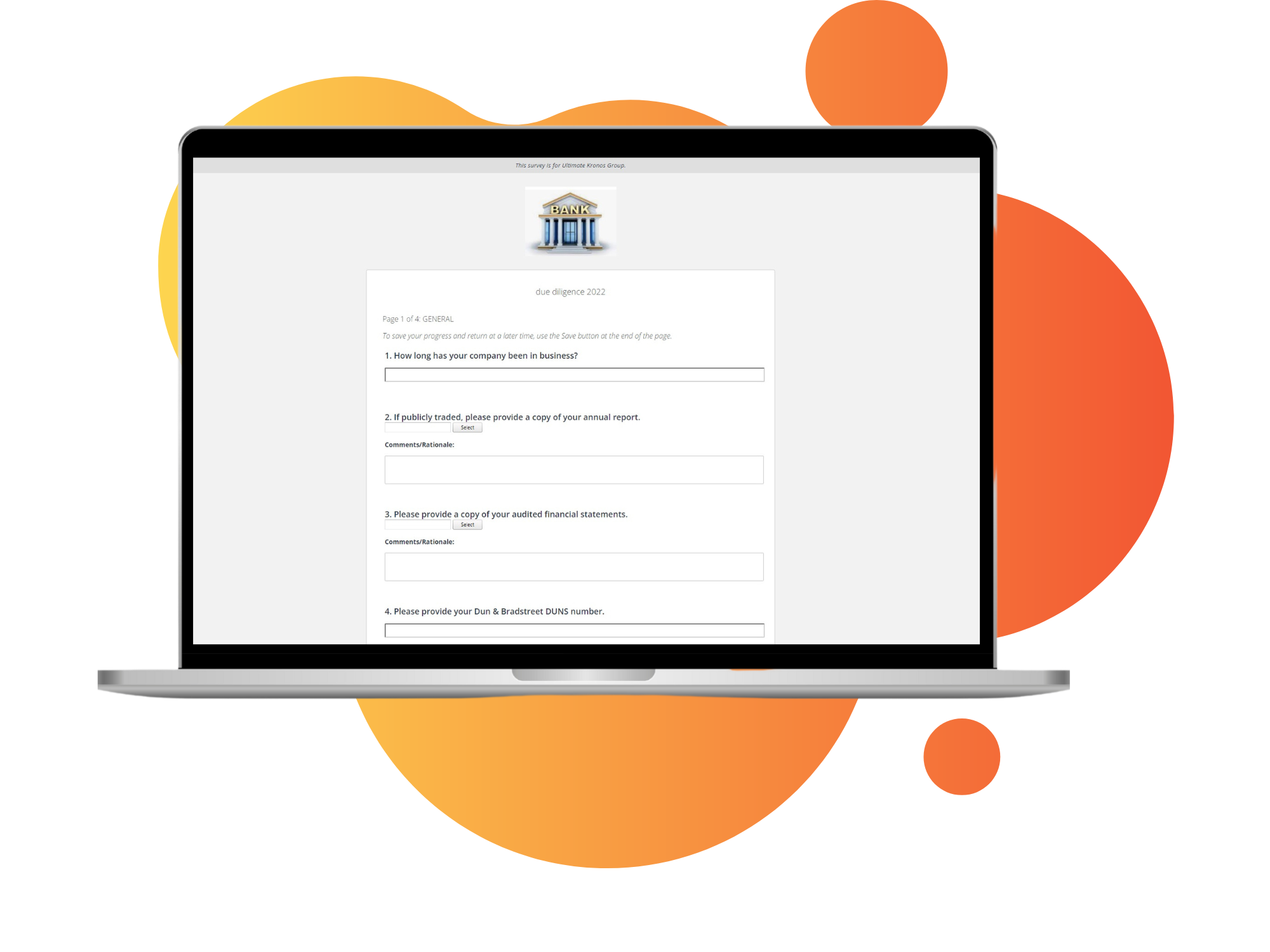

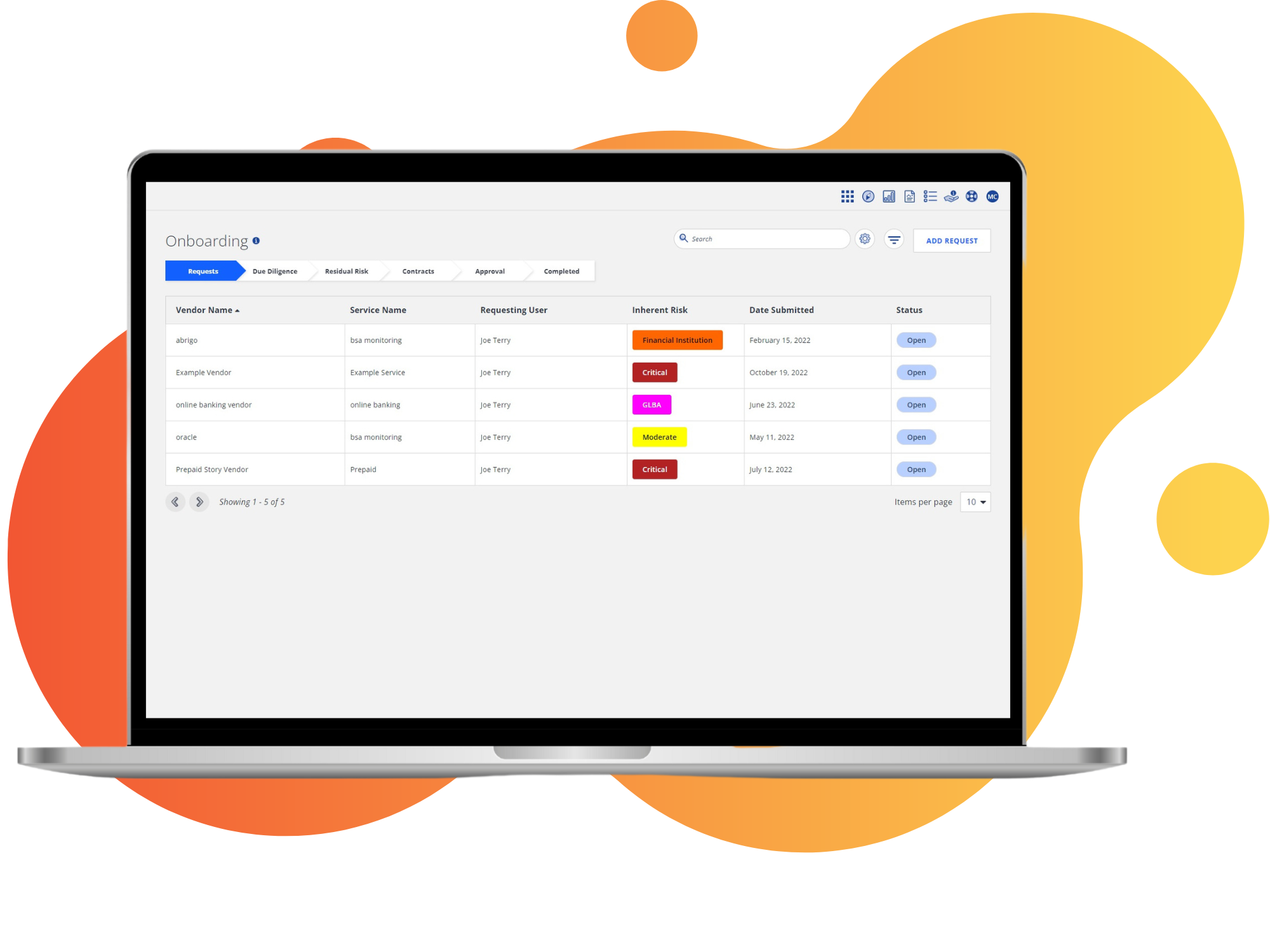

Experience swift and accurate vendor risk assessment and due diligence workflows, empowering you to navigate the vendor lifecycle with ease.

Precise Vendor Review

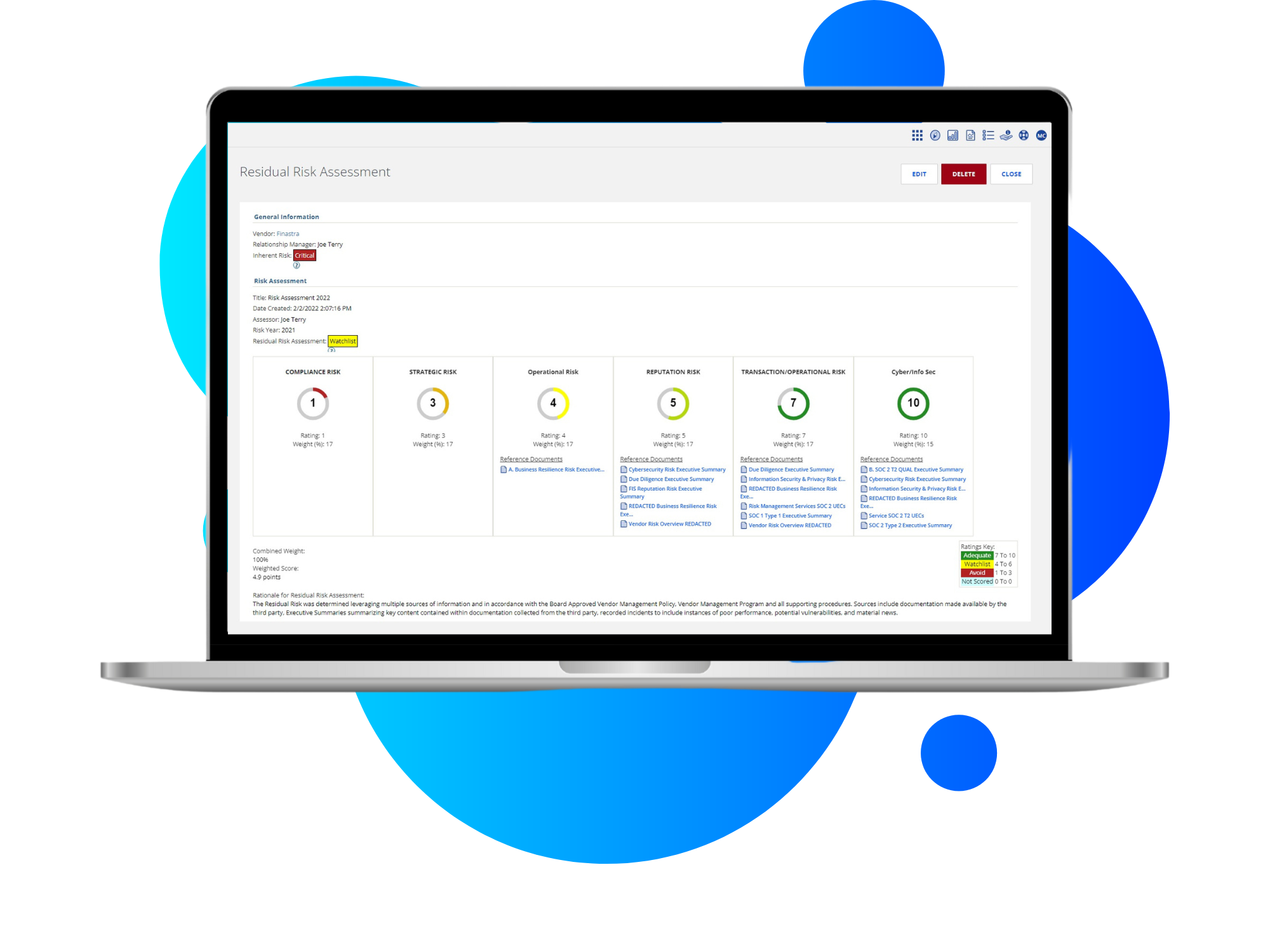

Our advanced risk tiering model enables precise vendor reviews based on key indicators, ensuring you focus on the most critical risks.

Perfected Contract Management

Effortlessly keep contracts updated and aligned with business goals, optimizing opportunities and mitigating risks.

Expert Guidance, Your Peace of Mind

Our professional services team handles vendor due diligence, reviews, and cyber monitoring, freeing you to prioritize customers and members.

Private Label Portal

Interact with vendors securely in a private label portal, accessing and managing documents effortlessly for streamlined operations.