Vendor Risk Management Software

Manage vendor relationships more easily and effectively – while reducing risk and costs – with third-party risk management software designed exclusively for financial service companies (including banks, credit unions, trust and mortgage companies, and fintechs).

From onboarding and risk assessments to contract management and ongoing due diligence, enjoy comprehensive, compliant oversight of the entire vendor management lifecycle.

Vendor risk management software for financial services companies

Insightful Third-Party Risk Management Software

You’ve got a reputation, a company, and consumers to protect. Are your third-party vendors protecting them too? Our vendor management system is here to help you find out.

Improve Efficiency and Third-Party Oversight

Store vendor data, contracts, and risk assessments in one place for easy access and analysis. Integration with other products ensures that vendor contact information is updated in business continuity solution, Ncontinuity. Proactively manage vendor incidents with integration with Nfindings.

Easily Onboard New Vendors

Approve new vendors in record time with less strain on your compliance staff. Workflows streamline the process of vetting potential vendors.

Work More Efficiently

Powerful collaborative tools and unlimited users make it easy to assign vendor owners and remind them to complete vendor due diligence – making vendor management more efficient by empowering those who know their vendors best.

Understand Third-Party Risk

Gain insights into critical and high-risk vendors with the help of customizable, expert-drafted vendor risk assessment models. Identify and assess the strength of security controls for mitigating risk and monitor vendor cyber risk in real time to quantify residual risk.

Comply with TRPM Requirements

Rely on industry best practices to manage each phase of the vendor management lifecycle to comply with regulatory guidance and reduce regulatory risk.

Vendor Risk Management Software Software Features at a Glance

Nvendor gives you the tools to streamline every step of the vendor management lifecycle and ensure compliance with third-party risk management guidance. Understand your vendors and your third-party risk with an effective vendor risk management program.

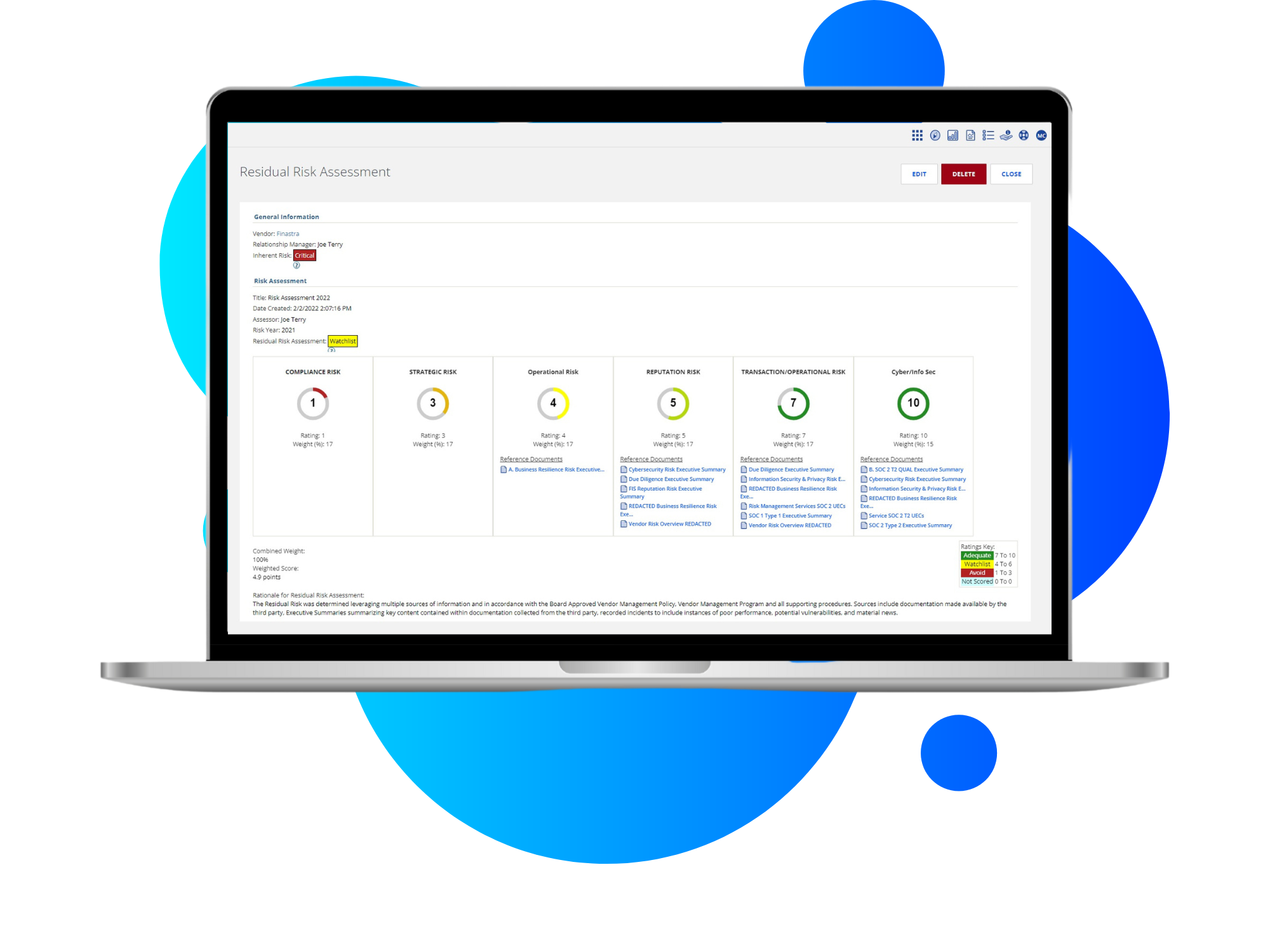

Configurable Inherent and Residual Risk Assessments

Vendor risk must be measured before it can be mitigated. Nvendor’s expert-crafted inherent and residual risk assessments take the guesswork out of quantifying risk. Customize the assessments to match your preferred vendor risk tiering system – whether that’s five, six, seven or more tiers. Industry best practice risk assessment methodologies ensures all reviewers use the same metrics for assessing risk and easily identify critical and high-risk vendors.

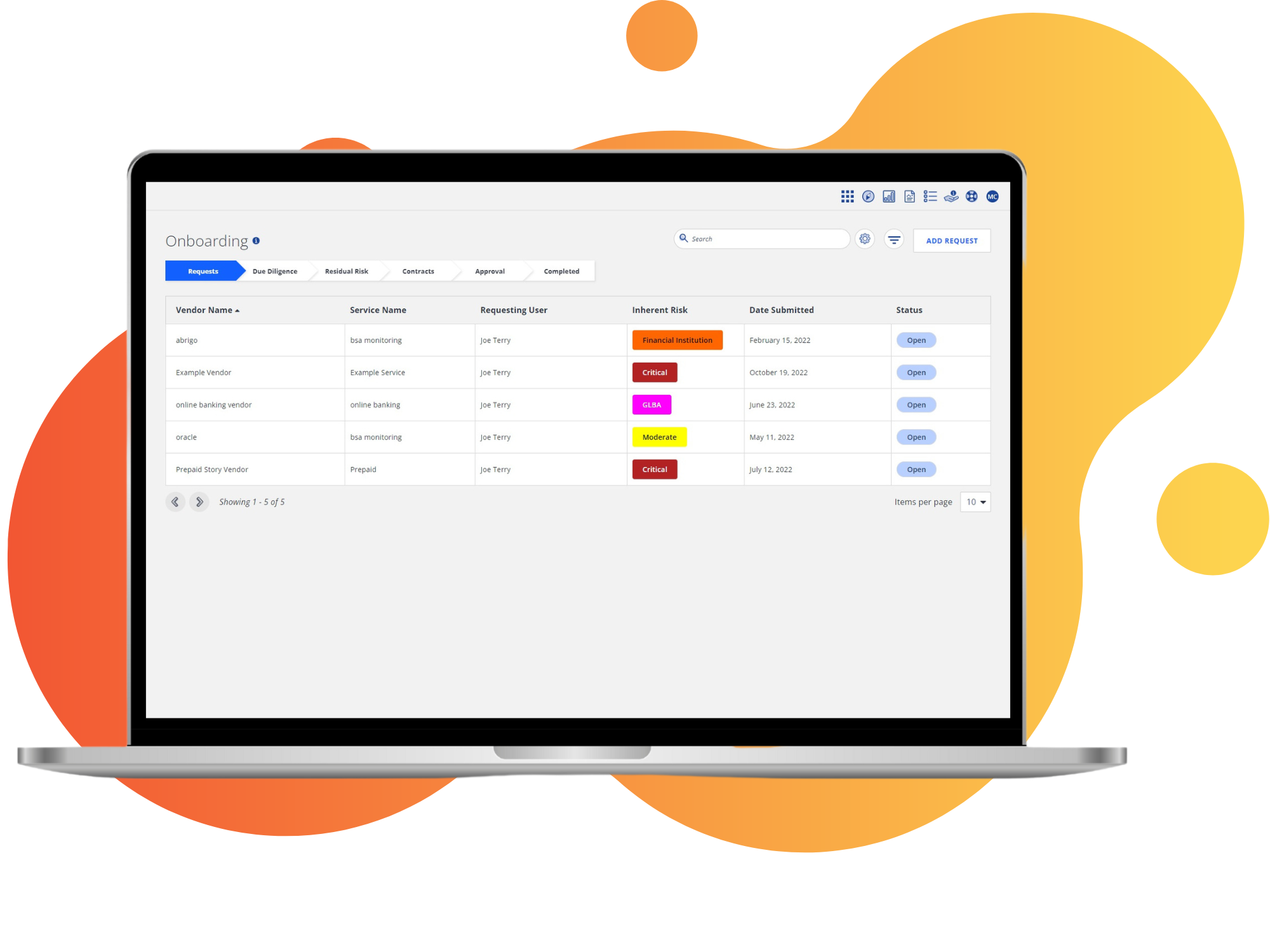

Onboarding Workflow

Replace manual, disconnected processes with a customizable workflow that guides users through every step of onboarding a potential vendor, including vendor request, due diligence, and residual risk. Embedded workflow tools show you exactly what due diligence is needed based on vendor risk tier. Drill down into each vendor to see where they are in the onboarding process, what tasks have been completed, and which are outstanding. Leverage workflow tools and automation to create efficiencies and eliminate duplicate manual data entry.

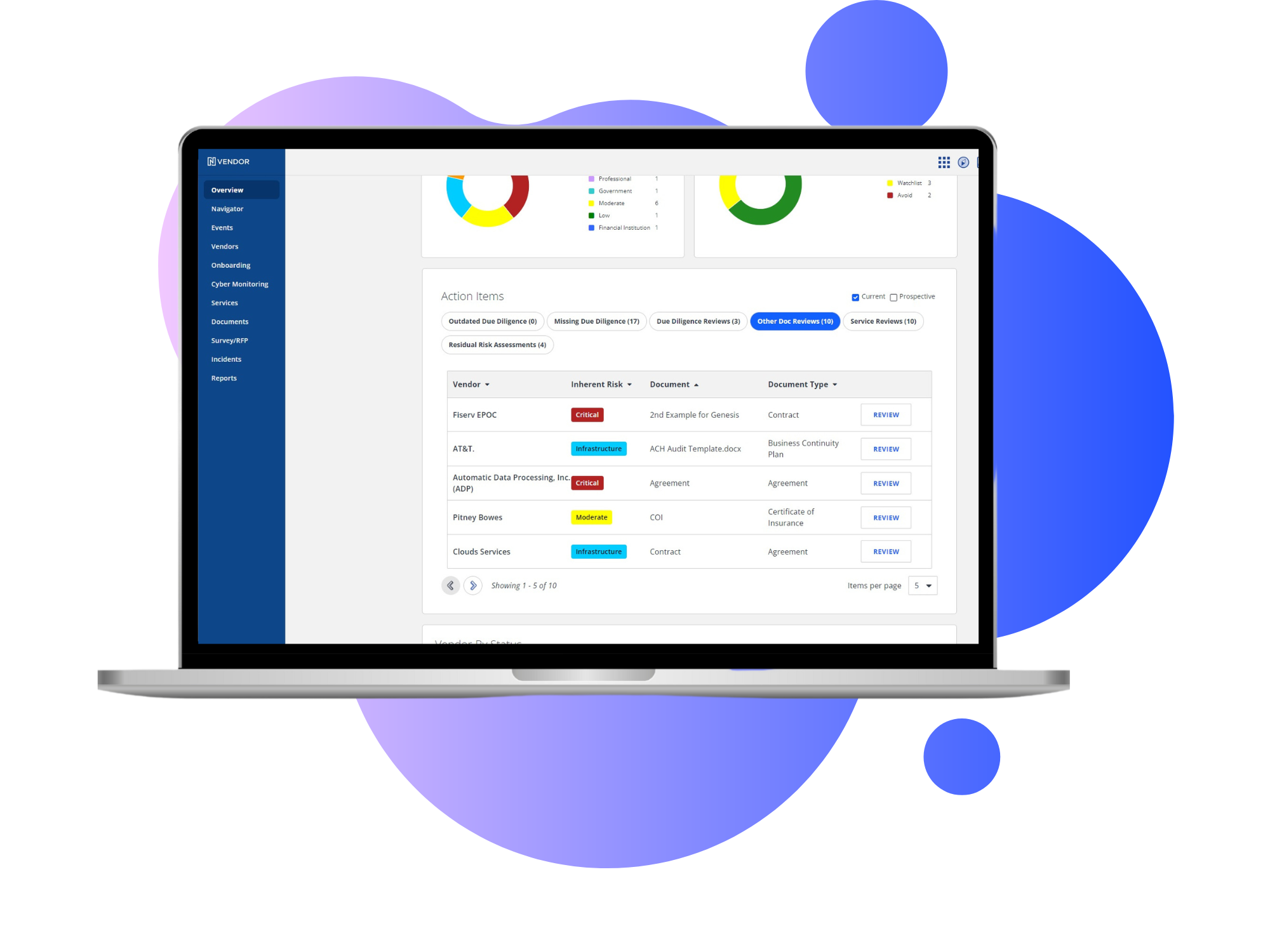

Centralized Dashboards, Data, and Reporting

Nvendor’s centralized vendor management repository gathers all your vendor-related documents in one place, making it easy to store, track, and manage each aspect of vendor management from initial prescreens and contract management to ongoing monitoring and exit strategies. Our secure portal lets you gather data from external or internal resources – everything from contracts to SOC reports.

Find data quickly thanks to easy-to-use software dashboards providing oversight of vendor management activity. Ensure continuous exam readiness with organized policy, procedure, and document management, alerts, and reports that can be customized for examiner standards and requests.

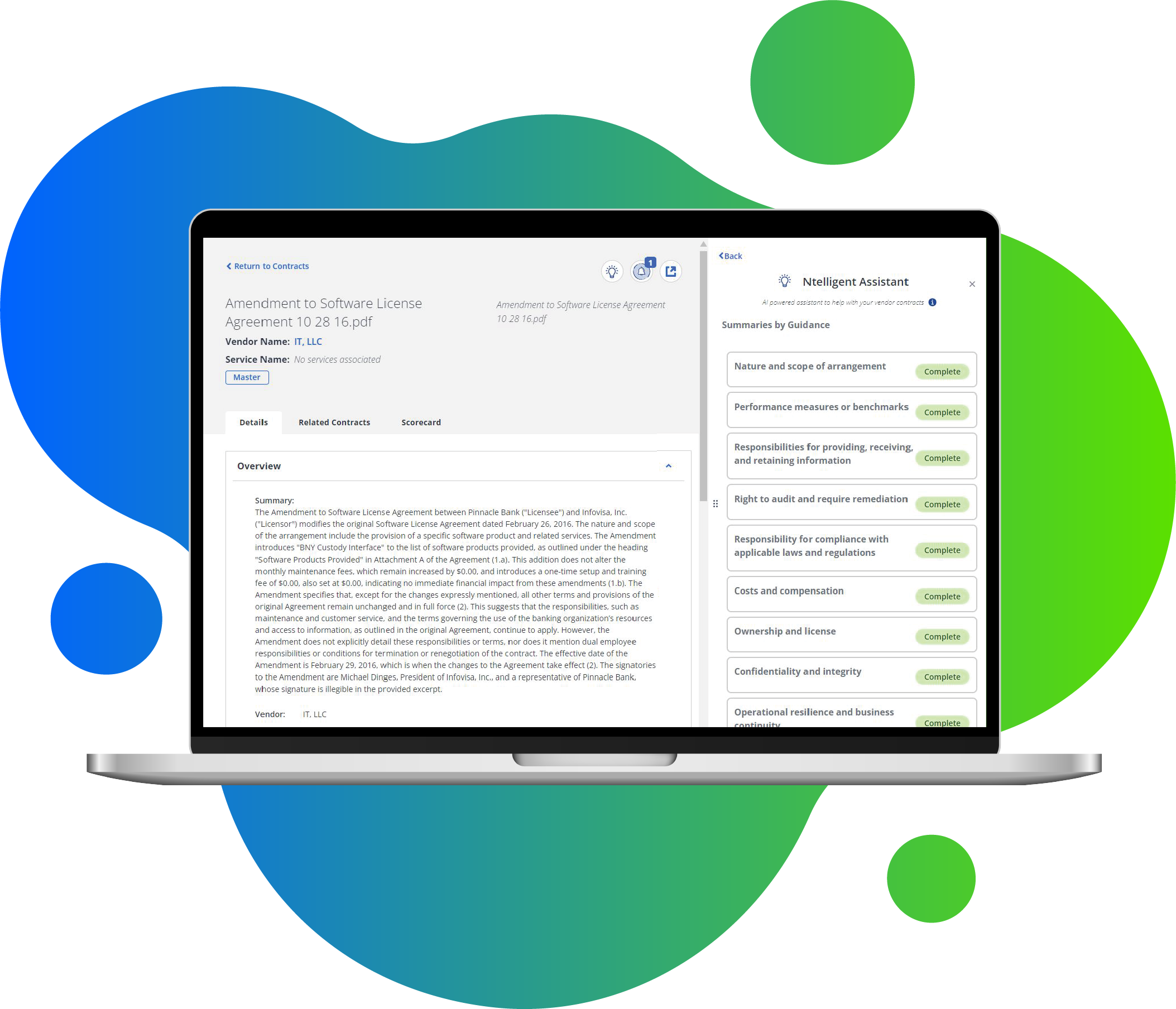

AI-assisted Contract Management

The Ntelligent Contract Assistant is a high-powered module in Nvendor that harnesses the power of artificial intelligence to seamlessly integrate time-saving contract reviews with Nvendor’s searchable contract management tools and comprehensive third-party risk management. Quickly score contracts for risk and regulatory compliance, identify key provisions related to pricing and expiration dates, or summarize contracts to streamline reviews.

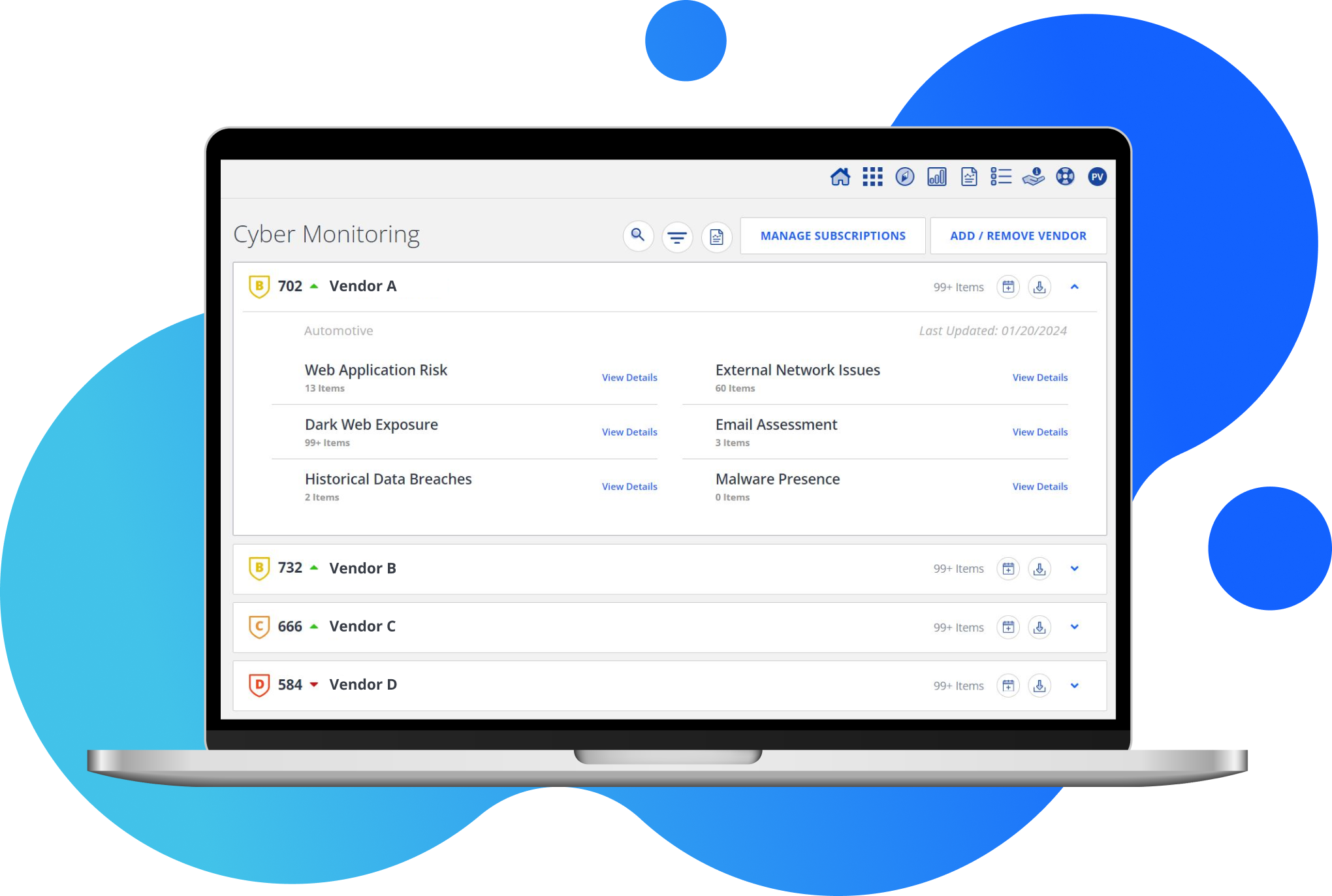

Optional Continuous Cyber Monitoring of Vendors

The Nvendor Cyber Monitoring add-on provides real-time monitoring of vendors’ cybersecurity. This service collects and assesses publicly available information about key vendors, including information on the dark web, to detect threats and vulnerabilities in real time. That gives you time to re-examine your controls and response strategies. Collected data can also be used to inform vendor risk assessments.

Negative news monitoring

Automated alerts

Integration with other Ncontinuity and Nfindings

Incident reporting

Professional services

Vendor's Keeper: How to Make Sure Your Third-Party Vendors Aren’t Creating a Compliance Nightmare

This whitepaper will explore the overlap between compliance and vendor management, offering strategies and best practices for mitigating the compliance risk of third-party vendors.

%20(1).png?width=1019&height=809&name=Copy%20of%20Various%20Clients%20%20Social%20Images%20(4)%20(1).png)

Frequently Asked Questions (FAQ)

Third-party risk management, also known as vendor management, is the systems and processes a financial institution or other organization uses to identify, measure, mitigate, and monitor risks associated with third-party relationships. These relationships include vendors, service providers, fintech partners, contractors, and consultants.

TPRM software, also known as vendor risk management software, is an automated tool for implementing a vendor risk management program. Software should empower financial institutions to document vendor management processes; identify, manage, monitor, and mitigate third-party vendor risk; document the reasoning behind choosing and maintaining specific vendor relationships; help analyze contracts and track key dates; quickly and easily generate reports; demonstrate board oversight; and tie into a bank’s overall approach to managing risk.

The Interagency Guidance on Third-Party Relationships: Risk Management, published by the Office of the Comptroller of the Currency (OCC), Federal Deposit Insurance Corporation (FDIC), and the Federal Reserve, warns that banks are responsible for the actions their third-party vendors.

If a third-party working on a bank’s behalf experiences a service disruption, violates a law or regulations, harms consumers, damages the bank’s reputation, or experiences a data breach, regulators won’t blame the vendor. They will blame the bank for poor oversight. Third-party risk assessment software gives banks the tools to manage TPRM relationships from beginning to end with greater visibility into the risks of working with vendors.

Credit unions, mortgage companies, fintechs, trust companies and other companies in the financial services sector can also benefit from TPRM software. Vendor risk management systems are a best practice. Consumers, members, and other partners don’t care who if technically it wasn’t your organization that made the mistake. Their relationship is with your organization, and they will hold you accountable.

Look for TPRM software specifically designed for your industry. The financial services industry has its own regulatory expectations and vocabulary surrounding vendor management. Instead of focusing on supply chains and inventory, your solution should be developed and maintained by financial services experts with real-world experience and a detailed understanding of your regulatory requirements, expectations, and the language you use.

Software should also be secure, cloud-based, and customizable to your need.

Vendor Management Practices Examiners Are Looking For

Want to know what examiners expect to see when they look at your vendor management program? Read on to find out.

Vendor Management Buyer's Guide

This buyer's guide will explain what to look for when selecting a vendor management system for your financial institution.

Third-Party Service Providers and Vendor Management

This new vendor management guidance from the federal regulatory agencies aligns requirements among the OCC, FDIC, and the Federal Reserve and replaces existing guidance.