Third-Party Risk and Compliance Software for Investment / Wealth Management

Mismanaging vendor contracts is expensive – costing businesses up to 10% in annual revenue. As specialists in vendor and contract management, our wealth management and broker-dealer compliance software helps your firm protect itself from costly vendor mistakes while complying with regulations and preparing you for the unexpected with compliant business continuity planning.

Integrated Wealth Management Compliance Software

Ncontracts’ RIA compliance solutions enable RIAs to proactively avoid costly vendor and compliance mistakes while maximizing operational efficiencies. As compliance burdens grow, investment advisors need to streamline manual processes and adopt automation for vendor management, business continuity, and FINRA/SEC compliance.

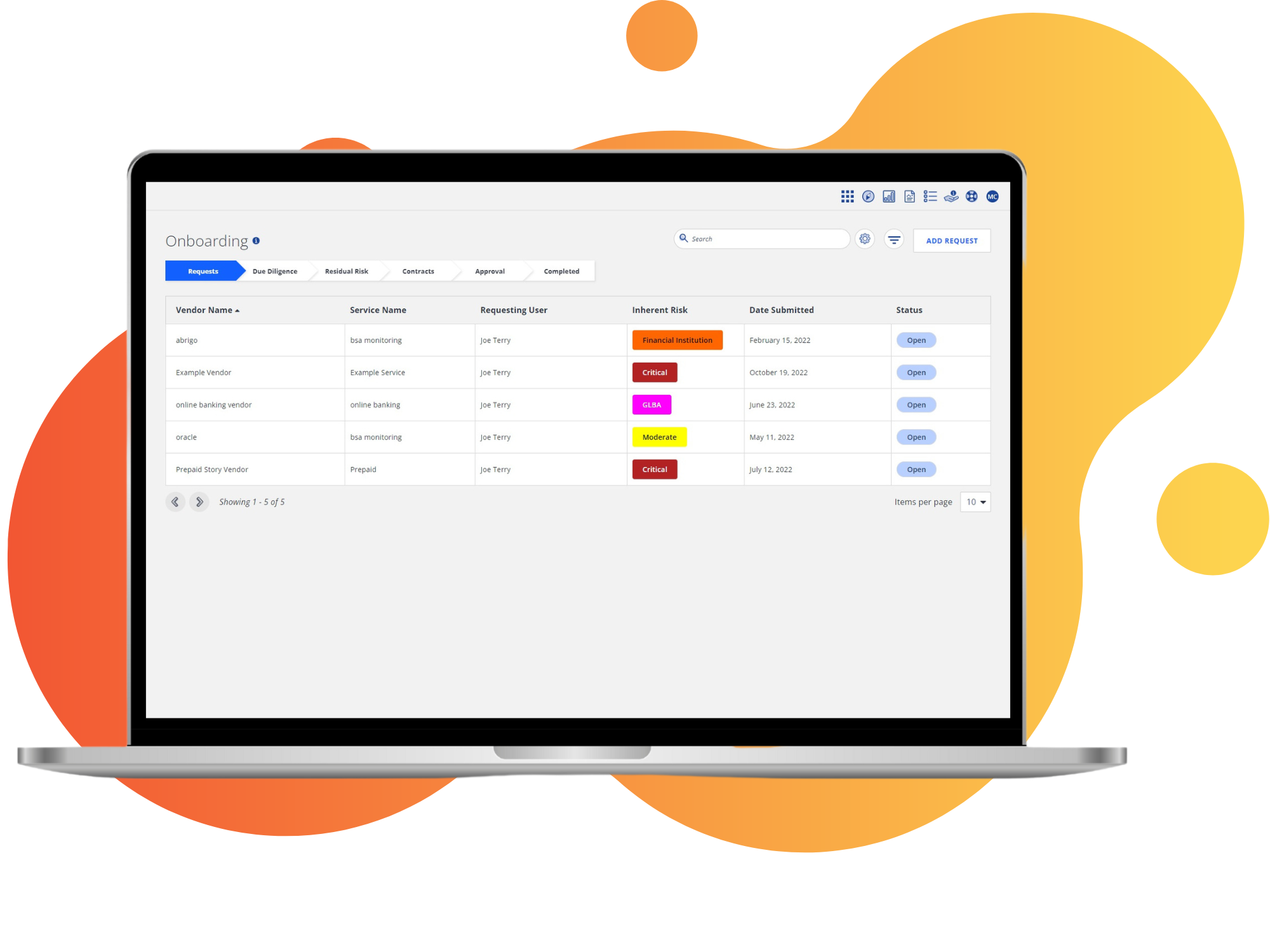

Vendor Management

Proposed SEC regulations require that investment advisors conduct due diligence and monitor their outsourced service providers. Current broker-dealer compliance software does not offer this function – Ncontracts does. Meeting regulatory requirements is one thing. But how do you know if your vendors are giving you the most value for your dollar? Our vendor management solution empowers RIAs to manage the costs of outsourced activities.

Business Continuity Management

What happens when your clients can’t access their online portfolio? They find a different advisor. With so many clients switching advisors, business continuity planning is a top priority for RIAs. It’s also a FINRA regulatory requirement that needs to be part of your asset management compliance program. You need a software solution that helps you plan for unexpected service disruptions and complies with regulations.

Compliance Management

Our investment compliance software includes all FINRA rules and guidance. Daily regulatory updates ensure that your investment firm stays ahead, enabling you to handle new regulations easily. Don’t overspend on a team of lawyers – when you invest in Ncontracts’ investment advisor compliance software, the regulations you need, curated by our compliance experts, are just a click away.

.png?width=750&height=677&name=Products%20Page%20Graphics%20NComply%20(1).png)

Vendor's Keeper: How to Make Sure Your Third-Party Vendors Aren’t Creating a Compliance Nightmare

Vendor contracts are vital for RIAs in lowering service-provider prices and maximizing value. Read our whitepaper: “Protect Your Interests: How to Negotiate Cost-Saving Vendor Contracts.”

%20(1).png?width=1019&height=809&name=Copy%20of%20Various%20Clients%20%20Social%20Images%20(4)%20(1).png)

Investment Advisor Compliance Software

Discover Ncontracts’ profit-driven compliance solutions

Explore financial advisor compliance solutions tailored to your business needs

Elevate your third-party risk and compliance management with our expert Solution Advisors in investment/wealth management. See out investment compliance software in action.

Articles & Thought Leadership

Everything from Fair Lending Compliance to Business Continuity Management and our cloud software capabilities.

What Investment Advisers Must Know About FinCEN’s AML/CFT Requirements

From Blueprint to Practice: 5 Tips for Implementing Sample Policies

RTO vs. RPO for Business Continuity: What’s the Difference?

Articles & Thought Leadership

Everything from Fair Lending Compliance to Business Continuity Management and our cloud software capabilities.

RTO vs. RPO for Business Continuity: What’s the Difference?

A Guide to Operational Resilience for Financial Institutions