Regulatory Alphabet Soup Part 2: The Predicted Death of GRC

As Gartner moves away from using the term GRC and towards IRM, we feel strongly the risk management industry will soon leave this buzzword out to die.

Attention Compliance Professionals: How to Leverage LinkedIn to Do Your Job Better

As a compliance professional, you can use LinkedIn to do your job better. Here are five tips you need to know, whether you're a beginner or an expert!

What Breed of Risk Manager Are You?

Take this fun quiz to find out what breed of risk manager you are.

The BSA/AML Compliance Pep Talk You Need

Ever wonder what happens to your SAR reports? Believe it or not, they actually pay off. Keep up the good work on your BSA/AML compliance efforts.

Top 13 Proven Benefits of HMDA Software for Fair Lending Compliance [Part 2]

In part two, learn even more benefits of HMDA software for your Fair Lending compliance! Fair Lending analysis is essential. Software makes it simple.

Top 13 Proven Benefits of HMDA Software for Fair Lending Compliance [Part 1]

Leveraging a HMDA software for data analysis and risk management can yield benefits for your Fair Lending & HMDA compliance program, and institution...

How to Use the CFPB's New HMDA Data Tool for the First Time

The CFPB is expected to release their HMDA data submission tool in the upcoming months. In this post, we'll discuss how to use the new HMDA Platform...

FDIC Supervisory Insights for Summer 2017: Focus on BSA

FDIC BSA 2017 Supervisory Insights. The FDIC released its Supervisory Insights for Summer 2017. This article summarizes that report.

How to Build a Strong Fair Lending & Redlining Compliance Management System

As you work to build a strong Fair Lending and Redlining compliance management system, here are a few things to keep in mind to help reduce risk exposure.

The Top 10 Worst Excuses for Not Analyzing HMDA Data for Fair Lending Compliance

Here are the top 10 worst excuses for not analyzing HMDA data regularly - and why they're risky. In addition, you'll learn some key data points to consider…

Déjà vu: Wells Fargo Can't Stay Out of Trouble

After its account-opening scandal last year, you’d think Wells Fargo would have examined all its policies and procedures

Here We Go Again: Vendor Cybersecurity Breaches Keep Wreaking Havoc

Vendor cybersecurity breaches once again wreak havoc on user data. Read about the millions of accounts hacked and leaked online from a telecomm giant.

3 Reasons Chief Risk Officers Fail

A new study concluded that big banks that employed a Chief Risk Officer were far more likely to be overexposed to the riskiest, new financial derivatives.

Beach Bummed: How One Construction Crew Ruined the Summer Season

The word disaster conjures up images of tornadoes, hurricanes, and terrorist attacks, but sometimes it starts with a construction crew.

7 Tips for How to Respond to Bad Compliance Exam Results

Compliance exams are stressful and challenging to endure. In this post, we will share 7 experience-tested tips for how to respond to a bad compliance exam.

OCC Singles Out a Bank Director for Excessive CEO Compensation

The OCC recently called out a bank director for misconduct around compensation. Here's a quick lesson in how to fail as a bank director.

Fair Lending Quiz: Assess Your Compliance Risk Exposure!

Fair Lending is still a top regulatory priority in 2022, and risk management is as important as ever. In this post, get access to a free Fair Lending quiz!

Redlining Analysis Remains a Top Priority for Regulators & Raises These 5 Questions

Regulators continue to prioritize Redlining compliance. In this post, you will learnwhy they say data analysis is essential for Redlining risk management.

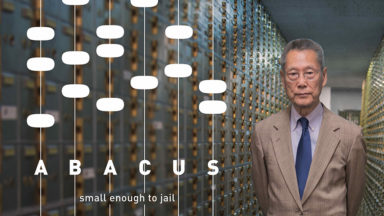

What Took 5 Years and $10 Million and Did Nothing to Punish Wall Street for the Mortgage Crisis?

Here's what we learned from this intriguing documentary about the only commercial bank criminally charged as a result of the mortgage crisis

8 Key Questions to Help You Determine Your Unique Fair Lending Risk

We can boil down the various Fair Lending laws (ECOA, FHA, etc.) to a single question that serves as the litmus test for Fair Lending compliance.

How Are You Coping with a Growing Vendor List?

As financial institutions work with more vendors, it's easy to miss third-parties who need to be reviewed just like more obvious ones.

Much Ado About Nothing: Update to the FFIEC Cybersecurity Assessment Tool Barely Worth a Mention

When we looked at the FFIEC's update to the cybersecurity assessment tool, we discovered the changes to be minor. Good news; Ncyber already has the update.

FDIC Guidance: Model Risk Management of Third-party Vendors

Model Risk Management: FDIC-regulated banks with more than $1 billion in assets and those that use a complex model that is will be subject to new guidance.

What is A Real-World Example of Fair Lending Discrimination?

Learn how Fair Lending discrimination risk can negatively impact your bank, mortgage company or credit union's reputation through these 3 examples!

5 Ways to Succeed at Vendor Management

Risk and vendor management is all about analysis and organization, but many risk officers get bogged down in organization and lose time for analysis.

9 Fresh Compliance Stories that Made a Splash this Summer

Here are 9 fresh consumer compliance news stories, published from late May through August, that you may have missed.

Don’t Confuse Clarity with Forgiveness

OCC to label violations of laws and regulations as “new,” “self-identified,” or “repeat” when communicating a violation to banks starting July 1.

STOP! Collaborate Cautiously and Listen- The OCC is Back with New Third-Party Risk Management Guidance

The OCC has published new guidance on 3rd-party risk management. Key takeaway: There is no one-size-fits-all approach to third-party risk management.

Spreadsheets Aren’t Free: 5 Hidden Costs

The costs your institution will incur if it’s using spreadsheets to oversee risk management or compliance may not be obvious until it's too late.

Visit Us at Booth 323 at the ABA Regulatory Compliance Conference This Weekend!

Visit us at Booth 323 at the American Banker's Association's annual Regulatory Compliance Conference! We will have games and a chance to win an Apple Watch…