RTO Meaning

RTO is defined as the maximum tolerable length of time that a computer, system, network or application can be down after a failure or disaster occurs.

Risk Management In Healthcare

Risk management is essential in any business, but risk management in healthcare, it can involve components unique to the medical community.

Risk Management Planning

While you may think that common sense could help businesses avoid risk, there are several risk management standards in place making this process more

Coming to a GSE Near You: Better Third-Party Risk Management via FHFA Guidance

If you’ve been holding off on formalizing your approach to vendor management, this is another sign that you need to get on board.

Monkey Business: What Two Gambling Monkeys Can Teach Us About Risk

Did you hear about the monkey gambling for drops of juice in a casino? It’s an actual experiment that gives us insights into risk and decision making...

Ammo for the Budget Battle: How Risk Management Delivers ROI

Need help communicating return on investment (ROI) for risk management software? Here are arguments to help make the case to management and the board

7 Things You Need to Know Before Buying Cybersecurity Insurance

Cybersecurity insurance doesn’t always cover your institution the way you expect. Consider these 7 things before you buy...

Poor Vendor Risk Management Costs Bank $4.75 Million

Compared to other agencies, the Fed hasn’t handed down very many enforcement actions for unfair and deceptive practices violating the FTC Act. Why then is

How to Set Up a Risk Committee

The risk committee helps ensure that management and the board understand each other. Here're tips on setting up a risk management committee.

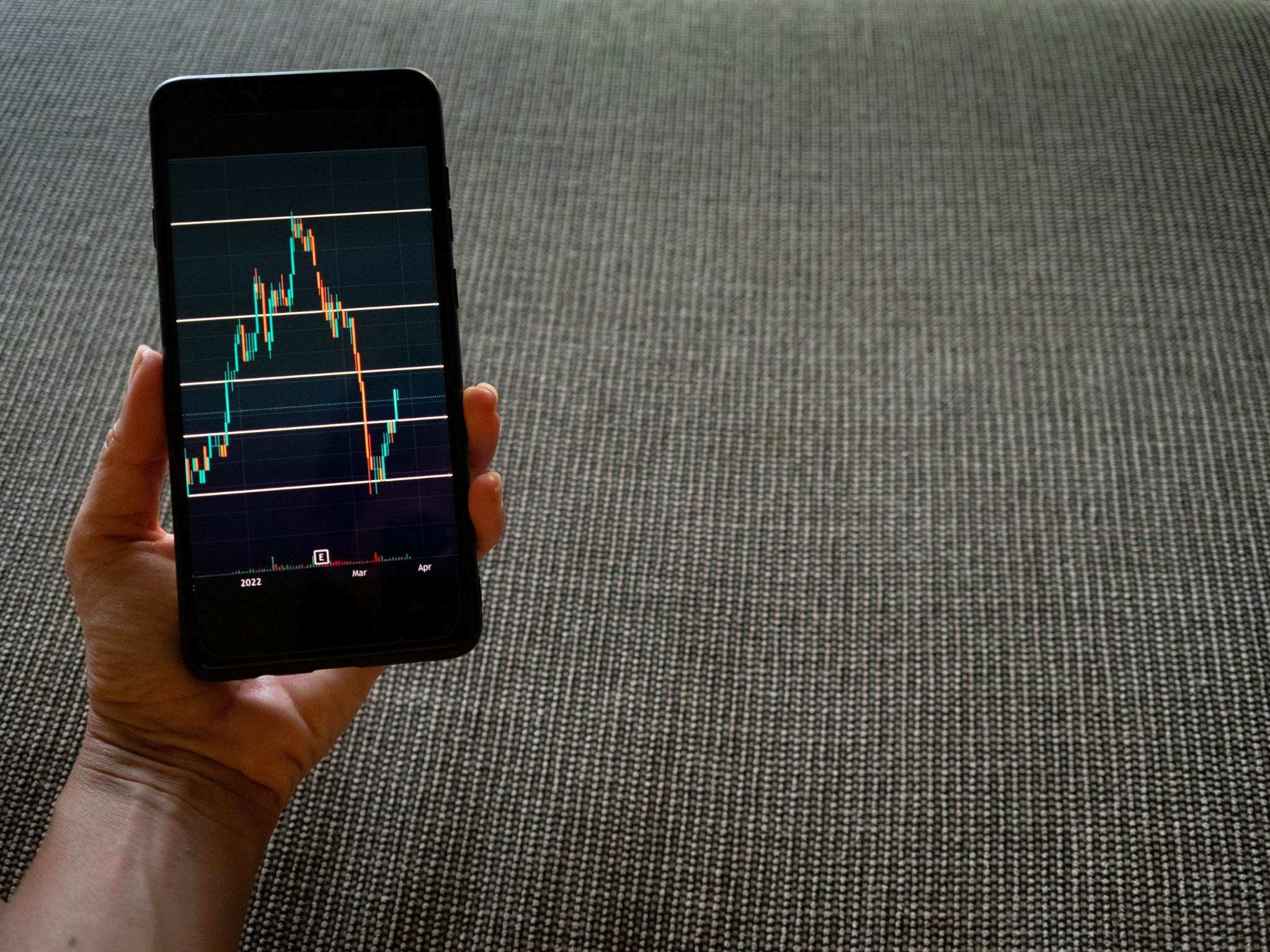

Risk Assessments 101: The Role of Probability & Impact in Measuring Risk

Risk assessment methodology for banks aren’t nearly as subjective as they may seem. Here, we walk you through exactly what you need to evaluate.

Which Risk Manager Would You Hire? Game of Thrones Edition

While we wait for next year’s final episodes, get your GoT fix with this hypothetical exercise in risk management hiring...

Are Silos Stunting Your Risk Management Efforts?

In risk management, there’s a big difference between thorough and redundant. Thorough is a unified, top-down approach with all decisions and discoveries

How to Understand Your Redlining Risk in 3 Simple Steps

Redlining risk is a red-hot topic for the regulators. Here are 3 simple steps for understanding and managing your redlining risk!

Wells Fargo Answers to a Higher Power Over Poor Risk Management

Forget the Federal Reserve and its prohibition against Wells Fargo's further growth until its governance and risk management improve. Wells Fargo is

Creating Reliable Risk Assessments: How to Measure Compliance Risk

A well-executed risk assessment digs into real-world risks and the specific controls an institution uses to mitigate their impact, allowing the

Creating Reliable Risk Assessments: How to Measure BSA Risk

The FFIEC recommends financial institutions conduct a BSA/AML risk assessment every 12 to 18 months or when new products or services are introduced,

Creating Reliable Risk Assessments: How to Measure Cyber Risk

From big picture ideas to specific areas of concern, a good risk assessment looks at the good and bad in every situation to provide a thorough

Creating Reliable Risk Assessments: How to Measure Data Security / GLBA Risk

A Gramm-Leach-Bliley Act risk assessment should identify reasonably foreseeable internal and external threats. Learn how to measure data security

Shelved Elves: Santa Ponders the Risks and Rewards of Outsourcing Toy Making

It’s crunch time at the North Pole, and Santa is worried. Despite his elves’ best efforts, he’s not sure they are going to be able to produce all the toys

OCC Bulletin 2017-43: Guidance for Risk Management of New Activities

In the OCC bulletin 2017-43, banks are reminded that new lines of business are rife with risk potential. Careful vetting is crucial. Nrisk can help.

3 Reasons Chief Risk Officers Fail

A new study concluded that big banks that employed a Chief Risk Officer were far more likely to be overexposed to the riskiest, new financial derivatives.

FDIC Guidance: Model Risk Management of Third-party Vendors

Model Risk Management: FDIC-regulated banks with more than $1 billion in assets and those that use a complex model that is will be subject to new guidance.

Ncontracts Acquires Supernal Software to Bring Customers BSA and Compliance Solutions

When I founded Ncontracts in 2009, my goal was to provide a way to make risk management more efficient by eliminating the unconnected data, duplicated

Why Inertia Creates Risk

Inertia is one of the greatest forces in the universe. It applies to banking and business and there are costs if inertia goes unchecked.

The Risks of Apple Pay for Banks and Credit Unions

In the race to remain competitive more than1,600 banks and credit unions have joined Apple Pay, probably hoping that some of Apple’s cool will rub off.

RiskTech vs RegTech

Don’t let the label of RegTech trick you into thinking that checking off to-dos on a list of tasks is compliance. Here's more on RiskTech in our article.

Cloudy with a Chance of Data Loss

Perhaps there’s no buzz word more confusing to bankers and credit union executives than the “cloud.” It evokes an ethereal image of data floating safely

Why You Need to Focus on Cybersecurity Risk Now

Rather than lump cyber risk in with other categories, it’s important for banks and credit unions to directly address this risk with their critical vendor

What is Concentration Risk - And What Does My Regulator Have to Say About It?

When most bankers and credit union executives think of concentration risk, they think of lending—but concentration risk has a different meaning whentalking

Country Risk - Why It Pays to Choose Domestic Service Providers

Think it’s tricky to keep track of the rules and regulations U.S. regulatory agencies? Imagine following operational requirements of foreign countries.