Fair Lending & PPP: Who Tells Your Story?

The Paycheck Protection Program is becoming a hot topic in Fair Lending. Who is going to tell your PPP Fair Lending story?

OCC Says Fair Lending Risk Is on the Rise

The OCC notes that overall compliance risk is increasing, calling out Fair Lending risk, in particular, is on the rise.

ABA Bank Compliance Magazine: Rolling the Dice on Ethics

ABA Magazine, Rolling the Dice on Ethics explores research and case studies to understand the relationship between compliance and ethics.

Third-Party Vendors & Compliance Risk: 10 High-Risk Compliance Situations

That’s the situation financial institutions face when a third-party vendor acting on behalf of the bank doesn’t comply with laws and regulations.

Unfair Lending: FTC Settlement Shows What Happens When Lending Policies Are Just Wrong

Here at Ncontracts, we tend to emphasize the important role of policies and procedures in ensuring Fair Lending compliance.

PPP: Fair Lending Fields in the Forgiveness Application & Updated Law

Just when you think you’ve finally wrapped your head around the Paycheck Protection Program (PPP), new information changes your outlook.

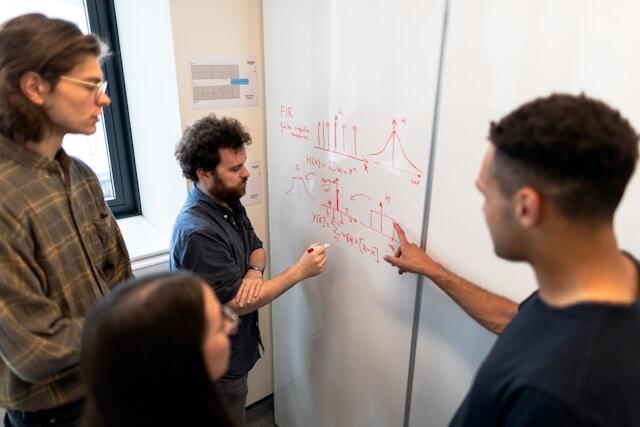

How To Work With The Board & Management: 6 Tips From A Top Compliance Officer

When a bank has a good compliance management system (CMS), training, an engaged board, and monthly testing.

Fair Lending FAQs Part 1: Exam Outlook, CRA & Mortgage Forbearance

Fair lending is always a hot topic. This is especially true when there are regulatory changes and lenders are scrambling to decipher the unintended...

4 Ways To Streamline Your CMS

Many institutions already have a strong compliance management system (CMS) in place.

How COVID-19 Is Impacting Fair Lending Compliance

Small business loan demand is through the roof thanks to government assistance programs, while low mortgage rates have resulted in high demand

Fair Lending Pitfalls: The CARES Act & Mortgage Loan Servicing

Congress passed the Coronavirus Aid, Relief, and Economic Security Act (more commonly known as the CARES Act) last month, learn how it effects you.

Examiners Want to Know: Does Your CMS Ensure Consumer Protection & Compliance?

Preventing consumer harm is among the top goals of financial regulators. That goal is best accomplished with streamlined CMS.

Coronavirus, HMDA, and Doing the Next Right Thing

As we struggle with disruption and uncertainty, as the coronavirus upends the routines of our lives, it’s natural to feel overwhelmed and unsure...

FinCEN Hits Chief Risk Officer with $450k Penalty

Michael LaFontaine got nailed because he was responsible for overseeing U.S. Bank’s compliance programs.

Leap Year: What Risk Management & Compliance Tasks Would You Tackle with One Extra Day?

That’s right, it’s Leap Year once again, and February 29th is happening for the first time in four years.

How to Prepare for the Future of AI in Banking (Part 2)

Unless you truly live in a cave, AI has put its stamp on your life—both at home and at work—and we can expect its influence to grow over the coming years

Why the OCC Is Like a Peanut Butter Cup and Other Podcast Insights?

Want to hear about OCC plans, initiatives, and priorities right from the OCC right from the source? You’ve got it!

CFPB Offers New Category of Guidance with “Compliance Aids”

The Consumer Financial Protection Bureau (CFPB) has historically provided an array of compliance resources including, compliance...

The #1 Obstacle Between Your FI and Strategic Success

The biggest obstacle to strategic success is failing to understand risk.

Three Banking Trends that Fizzled—And One That Stands the Test of Time

As we prepare for a new decade, let's take a stroll down memory lane to look at a few banking trends from the last 20 years that have lost their luster.

A Regulator's Holiday Wish List for the Year Ahead

We’ve been taking notes at industry conferences/meetings and know exactly what a federal regulator is hoping you’ll get them this year.

Compliance Managed: Four Ways to Streamline a CMS

Regulatory agencies have been emphasizing the importance of a strong and effective CMS, they’ve given financial institutions a lot of flexibility in...

Don’t Fear Artificial Intelligence: A Primer for AI in Risk & Compliance Management (Part 1)

Does the phrase “AI in risk and compliance management" conjure up images of robots taking over the world—or worse yet, replacing

What Does the OCC Look for in a CMS?

The OCC wants banks it regulates to “develop and maintain an effective CMS that is appropriate for the size, complexity & risk profile of its operations.”

What Does the Federal Reserve Look for in a CMS?

The Federal Reserve's CMS approach is based on two primary parameters: board & management oversight and the compliance program.

Risk Management Aids Prep for Risk-Focused Exams

Risk management helps financial institutions anticipate and guard against all kinds of risks. But did you know it can also help prepare for exams?

What Does the FDIC Look for in a CMS?

The FDIC expects a bank’s board of directors and management to have a compliance management system (CMS) adapted to its business strategy to effectively

7 Features Every Compliance Management System (CMS) Needs

Compliance management is no joke. Look for a compliance management solution with these seven key features...

Can You Adopt an Agile Approach to Compliance?

One of the buzzwords in business these days is “agile.” If you’re looking to learn more about what an agile approach is, and how it can be used in...

What Does the NCUA Look for in a CMS?

The NCUA defines a compliance management system as a credit union’s overall approach to managing compliance risk.