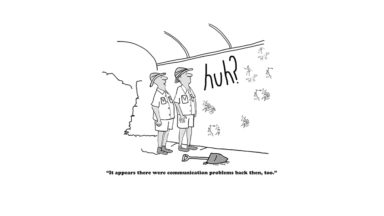

Don’t Confuse Clarity with Forgiveness

OCC to label violations of laws and regulations as “new,” “self-identified,” or “repeat” when communicating a violation to banks starting July 1.

STOP! Collaborate Cautiously and Listen- The OCC is Back with New Third-Party Risk Management Guidance

The OCC has published new guidance on 3rd-party risk management. Key takeaway: There is no one-size-fits-all approach to third-party risk management.

Will Your Vendors Fall Victim to Ransomware and Other Cybersecurity Threats?

63% of cybersecurity breaches occur through third-party vendors. That's why it's vital that your vendor management process protects you from threats.

Ncontracts Acquires Supernal Software to Bring Customers BSA and Compliance Solutions

When I founded Ncontracts in 2009, my goal was to provide a way to make risk management more efficient by eliminating the unconnected data, duplicated

FinCEN: MoneyGram Compliance Officer on the Hook for $250,000 Penalty

The former chief compliance officer of MoneyGram International was fined $250,000 this month and banned from serving in a compliance function.

Independent Banker Magazine Interviews Michael Berman, Ncontracts CEO

Independent Banker interviews Michael Berman on cybersecurity risk assessments and how financial institutions can stay secure.

Inside the New SSAE 18: Vendor Management Changes

The new SSAE 18 vendor management rules impact every financial institution. In this blog post, we look at each change and how it will affect your FI.

Risk Management Master: Q&A with Ncontracts’ Mitch Klein

Klein sat down to talk about managing risk, what it’s like to be on the vendor side of a relationship, and future risk management trends.

What Does Your Customer Data Have in Common with a Hit Netflix Show?

Vendor risk isn't limited to banks and credit unions. Hollywood is vulnerable too. Netflix revealed the entire season of Orange is the New Black was leaked

Vendor Management: What the NCUA Really Wants

When a financial institution outsources an activity to an outside vendor, it can enhance the member experience, but it can also introduce increased risk.

Whitepaper - Revelations from the FDIC's OIG Report

The FDIC's OIG found widespread deficiencies in the banking industry regarding vendor management. This whitepaper summarizes and explains these findings.

Vendor Management: What the Fed Really Wants

The Fed has specific needs regarding vendor management. This article looks at what the Fed wants when it audits your financial institution.

Vendor Management: What the FDIC Really Wants

Find out what the FDIC wants banks to know about vendor management. We explore part VII of the Compliance Exam Manual and pull out the nuggets of vm gold.

OCC Vendor Management: What the OCC Really Wants

You just found out you're getting a visit from the OCC. Vendor management is suddenly top priority what do they want? This is the resource you need to read

The Life of a Strategic Risk Manager: Building Buy-In

No matter how bright and organized a chief risk officer is, an institution’s ERM program is only effective when employees follow it.

OCC: Marketplace Lenders Are Third-Party Vendors

The OCC says marketplace lenders are third-party vendors. How does that affect your risk exposure? We look at how you're affected in this blog post.

Lessons from the CFPB: Why It’s a Bad Idea for a Banker to Name His Boat Overdraft

A lawsuit against TCF National Bank alleges that it tricked consumers into signing up for costly overdraft services in order to preserve its bottom line.

Are You Connecting the Risk Management Dots?

The OCC’s Semiannual Risk Perspective for Fall 2016 reinforces the agency’s enterprise wide approach to risk management, particularly to vendor management.

Don’t Let Heartbleed Lead to Vendor Management Heartbreak

A new study has found that the Heartbleed Bug remains a serious problem for nearly 200,000 Internet-connected devices raising questions about vendor mgmt.

Documentation is Key: Takeaways from the OCC’s Third-Party Vendor Risk Management Procedures

Ever wish for a list of exactly what an examiner is looking for? When it comes to the OCC and vendor management, your wish has been granted.

After Six Years, Agencies Fine Mortgage Processor $65 Million

It’s bad enough to be hit with a regulatory consent order. Now imagine the expense and public relations nightmare when those proceedings drag on for years.

Why Inertia Creates Risk

Inertia is one of the greatest forces in the universe. It applies to banking and business and there are costs if inertia goes unchecked.

The Risks of Apple Pay for Banks and Credit Unions

In the race to remain competitive more than1,600 banks and credit unions have joined Apple Pay, probably hoping that some of Apple’s cool will rub off.

Broker-Dealers Need Vendor Management Too

The Financial Industry Regulatory Authority (FINRA) is putting broker-dealers on notice that vendor management of cybersecurity will be a hot topic in 2017

RiskTech vs RegTech

Don’t let the label of RegTech trick you into thinking that checking off to-dos on a list of tasks is compliance. Here's more on RiskTech in our article.

Planning to Fail or Failing to Plan - Strategic Risk

Strategic risk is the possibility that a company doesn’t make decisions that support its long-term goals. Learn how to avoid these costly decisions.

Assess Vendor Reputation Risk - Before You Have to Rebuild Yours

Ben Franklin once wrote that “Glass, china and reputation are easily cracked, and never well mended.” Reputation risk can be mitigated through these steps

The Human Side of Vendor Management - What Vendor Management Can Learn From HR

Many financial institutions view vendors as a necessary evil, but extending a little trust to vendors goes a long way towards building a bridge to success.

One Size Doesn't Fit All - Updated Guidance from CFPB on Third-party Service Providers

The CFPB clarifies guidance on how to treat vendors of different sizes and impacts after many have been treated with equal scrutiny regarding due diligence

Surrogate Regulators: The Vendor Management / Fintech Connection

Should Fintech companies be regulated? With banks responsible for third-party services and the CFPB addressing regulatory concerns, is it necessary?