10 Best Practices for a Better Lending Compliance Program in 2025

How can institutions enhance lending compliance management in a complex regulatory environment? Here are best practices for 2025 and beyond.

1071 Update – February 2025

The latest 1071 compliance updates, news, and analysis for financial institutions and small business lenders covered under the CFPB’s Section 1071 rule.

Top 5 Takeaways from the 2024 Interagency Fair Lending Webinar: Redlining, HMDA Compliance & More

Learn about the emerging fair lending risks regulators are evaluating and effective strategies for mitigating risk.

Navigating Compliance Challenges: Lessons from Credit Union Enforcement Actions

Learn from the mistakes of credit unions and explore how your financial institution can mitigate risk and elevate your compliance program.

The Redlining Wake-Up Call: Lessons for Mortgage Lenders

Mortgage lenders must take action to address redlining risks and ensure fair lending practices to avoid severe penalties. Learn more.

DOJ Fines Credit Union $6.5 Million in Redlining Settlement

First-ever credit union DOJ redlining settlement shows that fair lending is a credit union challenge too.

8 Red Flags Indicating Potential Fair Lending Risk

When assessing Fair Lending risk, it’s not just what your FI is doing, but what it’s not doing. These 8 red flags may indicate potential Fair Lending risk.

Fair Lending DOJ Referrals Up 175%: How Many Did Your Regulator Refer?

Find out which fair lending violations are leading to DOJ referrals for banks and credit unions – and how to protect your financial institution.

Managing 1071 Costs

Small business lenders worried about the high cost of Section 1071 implementation should consider the benefits of outsourcing.

DOJ Settles $9 Million Redlining Suit with Bank

How does your financial institution manage unintentional redlining? Regulators require data that demonstrates HDMA compliance.

3 Things Compliance Officers Should Do to Prepare for an Exam

We'll share 3 actions the best compliance officers take, and 6 steps for Fair Lending exam prep. If you have an upcoming exam, you need to read this.

Recent Trends in Fair Lending Compliance

The DOJ is bringing Fair Lending Lawsuits against financial institutions. Is your institution prepared? Read more about recent trends in fair lending compl…

Inside the CFPB Fair Lending Report 2023

Find out the latest fair lending violations across the agencies and where they’ll be looking next as we share highlights of the CFPB Fair Lending Report.

Section 1071 Data Collection: What Is “Reasonably Designed?”

Ncontracts answers your questions about reasonably designed procedures for Section 1071 small business data collection procedures and timing

Changing Census Tracts and the Impact on Your Fair Lending Analysis

Changes to census tracts from the 2020 census can impact your Community Reinvestment Act (CRA), redlining, and other fair lending analytics.

Consumer Fair Lending Analysis - What's in a Name?

Examiners are conducting Fair Lending comparative analysis using “surrogates” to assign gender and ethnicity.

Redlining Enforcement in 2023 Already Cost Banks $40 million

Redlining enforcement is heating up. Here are best practices to avoid and correct unintentional redlining.

How to Tell Your HMDA Data Story

HMDA data story best practices – everything from data collection and analysis to board reporting

1071 Update: Q&A with a Reg Expert

Ncontracts 1071 expert answers frequently asked questions (FAQ) about 1071 (commercial HMDA)

3½ Questions Before You Change Compliance Policy: Are You a Maverick?

3.5 questions you should always ask before implementing any new regulatory compliance policy. Don't be a Maverick.

Lending Compliance Q&A for Lenders

Lenders are focused on bringing in and closing loans, but they are also responsible for compliance. Here are some Q&As to help stay focused and compliant.

Are Your Written Lending Policies Keeping Pace with the Economic Environment?

Banks, credit unions, and mortgage companies need to reassess lending policies, including fair lending, in an evolving economic environment

DOJ & CFPB Follow Up on Promise for “Vigorous” Redlining Enforcement with $24 Million Mortgage Company Settlement

3 redlining enforcement takeaways for mortgage companies.

7 Fair Lending Risks You Need to Know Right Now

As Fair Lending Compliance gains greater attention, financial institutions must understand the seven primary risks.

Credit Union Fair Lending: The Most Common Mistakes & Violations

NCUA shares credit unions’ most common fair lending mistakes and violations.

8 Common Fair Lending Compliance Myths - and the Realities!

Here are the 8 Common Fair Lending Myths - and the Realities! Learn more and get this free download to reduce your Fair Lending risk today!

Is Your FI Complying with Fair Lending Laws? - Leverage Analytics

Is your financial institution complying with Fair Lending laws? It’s a deceptively simple question with a complicated answer.

Fair Lending Analysis: 3 Methods for Determining Borrower Race & Ethnicity

When examiners look at your loan portfolio for fair lending, they want to see how your financial institution performed across different races and...

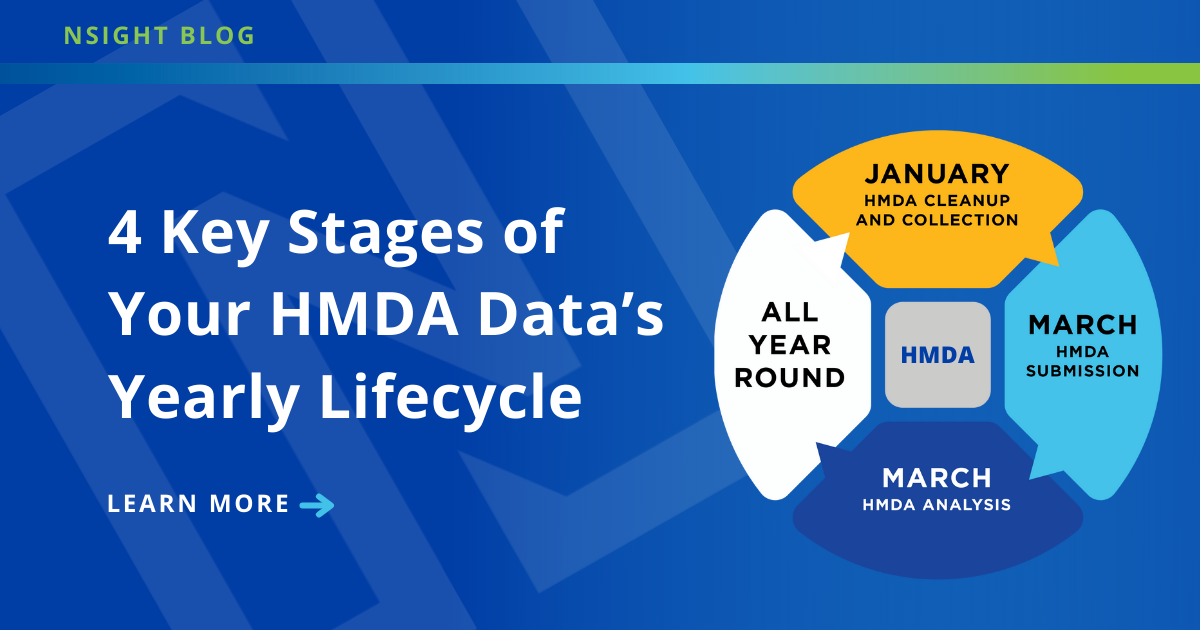

4 Key Stages of Your HMDA Data's Yearly Lifecycle

All HMDA data goes through four key phases in its yearly lifecycle. Learn what those phases are, and best practice strategies to help...

What Is Appraisal Bias and How Can My Financial Institution Avoid It?

7 best practices to avoid discriminatory appraisals—and the risk of litigation and regulatory trouble that comes with them