What Is Compliance Risk?

Explore rising compliance risk concerns for financial institutions and how to navigate evolving compliance requirements.

10 Best Practices for a Better Lending Compliance Program in 2025

How can institutions enhance lending compliance management in a complex regulatory environment? Here are best practices for 2025 and beyond.

Navigating Compliance Challenges: Lessons from Credit Union Enforcement Actions

Learn from the mistakes of credit unions and explore how your financial institution can mitigate risk and elevate your compliance program.

8 Red Flags Indicating Potential Fair Lending Risk

When assessing Fair Lending risk, it’s not just what your FI is doing, but what it’s not doing. These 8 red flags may indicate potential Fair Lending risk.

Consumer Fair Lending Analysis - What's in a Name?

Examiners are conducting Fair Lending comparative analysis using “surrogates” to assign gender and ethnicity.

Lending Compliance Q&A for Lenders

Lenders are focused on bringing in and closing loans, but they are also responsible for compliance. Here are some Q&As to help stay focused and compliant.

The 8 Steps to Scoping a Fair Lending Compliance Exam

The Fair Lending exam procedures starts with these steps. Determine the areas of focus for your next risk assessment or exam.

Is Your FI Complying with Fair Lending Laws? - Leverage Analytics

Is your financial institution complying with Fair Lending laws? It’s a deceptively simple question with a complicated answer.

15% of Credit Unions Have Consumer Compliance Violations. Are You One of Them?

Weak compliance management systems causing credit union consumer compliance violations

Fair Lending Analysis: 3 Methods for Determining Borrower Race & Ethnicity

When examiners look at your loan portfolio for fair lending, they want to see how your financial institution performed across different races and...

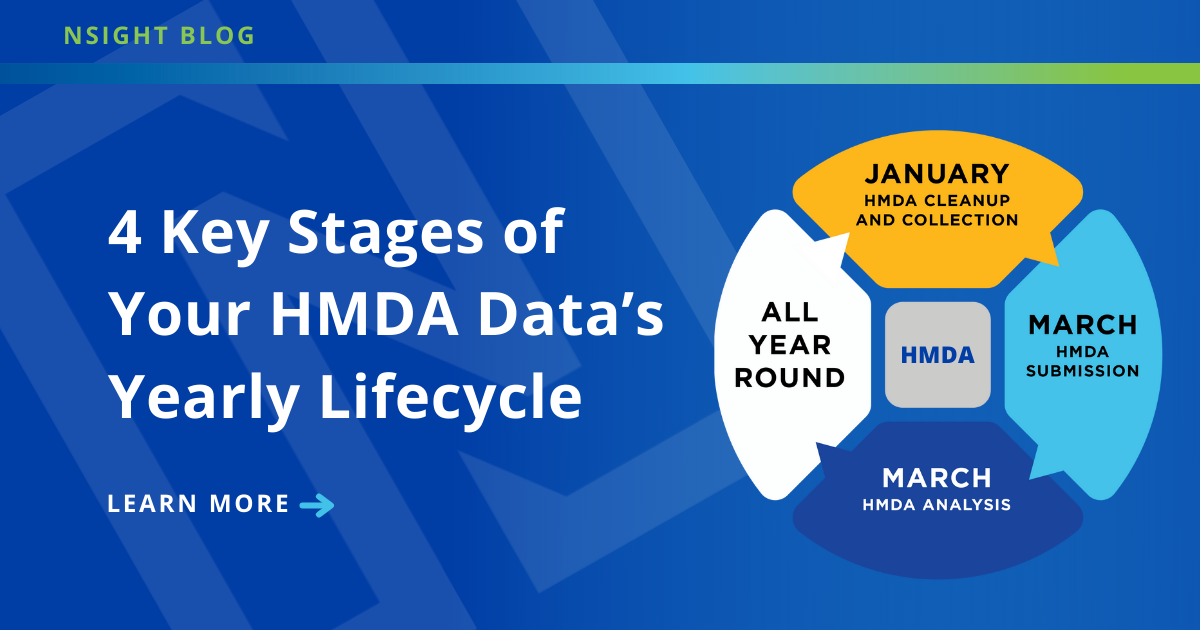

4 Key Stages of Your HMDA Data's Yearly Lifecycle

All HMDA data goes through four key phases in its yearly lifecycle. Learn what those phases are, and best practice strategies to help...

What Is Appraisal Bias and How Can My Financial Institution Avoid It?

7 best practices to avoid discriminatory appraisals—and the risk of litigation and regulatory trouble that comes with them

52 HMDA Filing Questions Answered by Compliance Experts

Our compliance experts answer questions about HMDA filing for your financial institution.

What Does the New Illinois CRA Law Mean for Mortgage Companies & Credit Unions?

FAQ for Illinois state CRA law and top tips for CRA compliance

The Top 10 Fair Lending Blog Posts of 2021

HMDA, redlining, CRA and other fair lending risks for banks, credit unions, mortgage companies and fintechs.

Is Your Commercial Lending Department Complying with Fair Lending Laws?

Self-evaluating commercial lending fair lending risk at banks and credit unions before Section 1071 implementation

UDAAP: Not Just a Fair Lending Issue

Make sure your financial institution is assessing and mitigating UDAAP risk

3 Steps to Develop a Community Reinvestment Act (CRA) Complaint Management Program

How to make sure your community bank is catching CRA complaints suggesting evidence of redlining or other discriminatory practices

CFPB, OCC & Justice Department Team Up for $9 Million Redlining Suit as Part “Vigorous” Fair Lending Enforcement Effort

Justice Department will “spare no resource” to ensure “vigorous” fair lending law enforcement, including a focus on redlining

CFPB Moving Forward with Section 1071 Rulemaking: 5 Things Your FI Needs to Know to Prepare

Insights into the HMDA for Small Business proposal from the Consumer Financial Protection Bureau (CFPB).

Regulators Are All About Fair Lending Enforcement—Including at Credit Unions

NCUA shares credit unions’ most common fair lending mistakes and violations.

7 Fair Lending Myths for Credit Unions

Our compliance experts debunk some of the most common myths about fair lending compliance for credit unions.

The CRA Examination Process Explained

Our compliance experts discuss the 3 phases of a Community Reinvestment Act exam for financial institutions and provide guidance on how to prepare for...

43 Questions and Answers Regarding the S.2155 HMDA Partial Exemption

Questions about whether HMDA reporting under S.2155 HMDA Partial Exemption will affect your financial institution? We’ve got answers—and solutions.

Watch Out for These Common Fair Lending Violations

MDA data errors and redlining are hot issues at the CFPB.

4 Common TRID Violations Observed by the Federal Reserve

Missing or inaccurate info on loan estimates and closing disclosures can lead to trouble.

2020 HMDA Data: 5 Takeaways for 2021

Insights into minority, low- and moderate-community mortgage lending.

Beware Fair Lending Risk in Loan Originator Compensation Programs

Loan originator compensation is a key source of fair lending risk. Proactive management of Regulation Z and fair lending compliance can help your FI avoid …

7 Ways to Analyze Your Data for Redlining Compliance Risk

Regulators, public interest groups, and the media are analyzing your financial institution's data for redlining. You should be, too.

Your CRA Exam Is Coming Up: Do You Have Enough Community Development Credit?

What counts as Community Reinvestment Act (CRA) credit?