Wells Fargo Scandals: Re-Established 2018

Wells Fargo Scandals: Re-Established 2018 - Barely a month after launching its “Re-Established” ad campaign with ads about “Earning Back Your Trust”,

Should You Outsource Vendor Management?

For years, financial institutions have outsourced a variety of activities to third-party vendors creating a new conundrum: Should vendor management be

Two Shocking Contract Management Mistakes That Cost Bankers Their Jobs

You probably think of vendor contract management as something that protects your institution. That’s true, but it does much more than that.

FS-ISAC: Third Parties “Still a Big Risk”

Financial institutions need to continue to pay close attention to third-party access points, control objectives, reporting, monitoring, and gap analysis

Are Silos Stunting Your Risk Management Efforts?

In risk management, there’s a big difference between thorough and redundant. Thorough is a unified, top-down approach with all decisions and discoveries

First, Second, Third, Fourth and Fifth Parties: How to Measure the Tiers of Risk

The importance of vendor risk management extends beyond third-parties. Take a look at the other parties involved and the potential risks they pose.

OCC: Third-Party Providers Contribute to 'Elevated' Operational Risk

Could a third-party provider be the weak link in your institution’s operations? It’s possible, according to the Office of the OCC

Risk Management: How Do You Measure Up?

There’s something tantalizing about comparisons. It’s nice to know where you stack up when it comes to both your peers and the institutions you aspire to

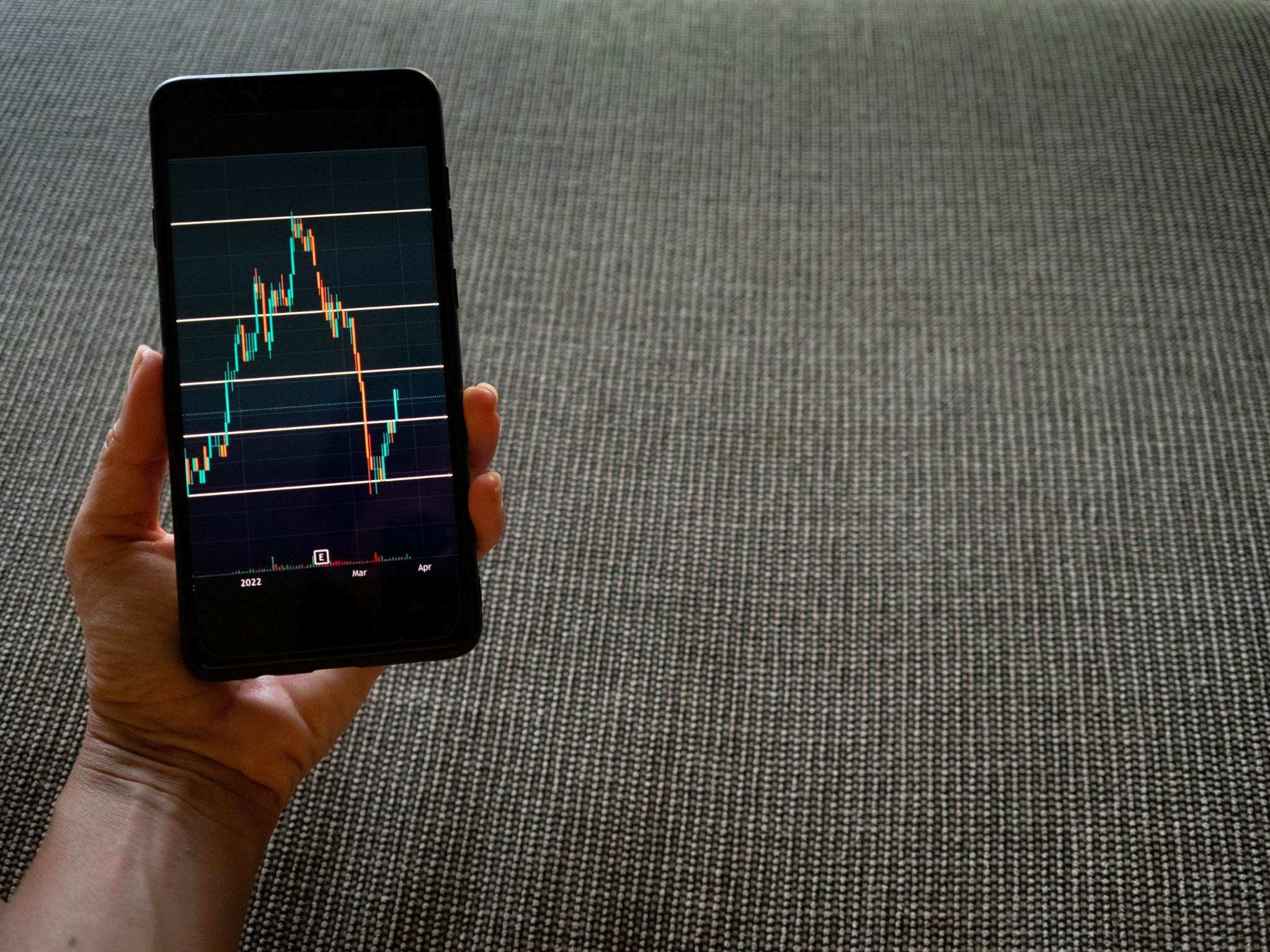

Willing to Take a Gamble? Don't Wager on High-Risk Activities Without a Careful Risk Assessment

Sports gambling is the latest high-risk business opportunity to open up to banks. Add that to state-level legalization of recreational and medical

Congress is Rolling Back Regulations. Can You Roll Back on Risk Management?

Banks and credit unions across the country are rejoicing at the passage of the Economic Growth, Regulatory Relief and Consumer Protection Act.

Notifying Clients of Data Breaches: Which State Law Should We Follow?

Your financial institution is regulated by one state but has an office in another state. Which state’s law do you follow in the event of a data breach?

How to Respond When a Vendor Gets Hacked

A vendor data breach is a nightmare for any bank or credit union. From the financial cost to the bad press to the regulatory attention, data breaches pose

When Your Vendor Says ‘Your Data Was Breached—Six Months Ago.’

What’s worse than a vendor that suffers a data breach that exposes your sensitive customer information? The answer: A vendor that waits almost

New Regulatory Guidance About Cybersecurity Insurance

Does your institution need cyber-security insurance? Is it required? If utilized, are there rules? Cybersecurity insurance can protect against

Are You and Your Vendors Ready for GDPR?

All may be relatively quiet on the regulatory front in the U.S., but this May new privacy regulations are taking effect in the European Union

3 Reasons Why Cybersecurity Ratings Are a Waste of Money

Investigating a vendor's cybersecurity can be a time-consuming hassle. Wouldn't it be nice if you could pay someone else to monitor and report back on a ve…

How to Break Up with Your Vendor

There may be 50 ways to leave your lover, but when it comes to ending a relationship with a vendor there’s really just one path to follow...

Is Your Bank Considering a Merger or Acquisition? Here's How Compliance Risk Can Impact the Deal

We're expecting to see a renewed wave of bank M&A activity over the coming months, driven by a rising SIFI threshold. If your bank...

Increasing Risk May Not Mean What You Think It Does

When risk increases, the natural response is to take action to reduce that risk. But not every increase requires action. In fact, it may distract you from

Can Improving the Customer Experience Aid Risk Management?

Banks are on a quest to improve the customer experience. A new study of North American bank operations leaders by Accenture believe the

Wells Fargo Answers to a Higher Power Over Poor Risk Management

Forget the Federal Reserve and its prohibition against Wells Fargo's further growth until its governance and risk management improve. Wells Fargo is

Ticking Time Bomb: Why A Free Vendor Management Checklist Is A Disaster Waiting to Happen

There is temptation in the world of management. With regulatory scrutiny increasing and cost a concern, free vendor management checklists seem

What Does the N in Ncontracts Stand for Anyway?

Nashville? Network? Need? Those are just a few of the most common guesses when people ask me what the N in Ncontracts stands for.

Creating Reliable Risk Assessments: How to Measure Compliance Risk

A well-executed risk assessment digs into real-world risks and the specific controls an institution uses to mitigate their impact, allowing the

Creating Reliable Risk Assessments: How to Measure BSA Risk

The FFIEC recommends financial institutions conduct a BSA/AML risk assessment every 12 to 18 months or when new products or services are introduced,

Creating Reliable Risk Assessments: How to Measure Cyber Risk

From big picture ideas to specific areas of concern, a good risk assessment looks at the good and bad in every situation to provide a thorough

Creating Reliable Risk Assessments: How to Measure Data Security / GLBA Risk

A Gramm-Leach-Bliley Act risk assessment should identify reasonably foreseeable internal and external threats. Learn how to measure data security

Shelved Elves: Santa Ponders the Risks and Rewards of Outsourcing Toy Making

It’s crunch time at the North Pole, and Santa is worried. Despite his elves’ best efforts, he’s not sure they are going to be able to produce all the toys

Misleading Vendor Marketing Costs Missouri Bank $5 Million

A Missouri bank must pay consumers $5 million in restitution after a third-party vendor deceptively marketed balance transfer credit cards.

Did You Hear the One About the Community Bank and the Russian Oligarch?

A Utah bank gets a lesson in due diligence when it discovers an account holder is one of Russia's wealthiest oligarchs with direct ties to Vladimir Putin.