7 Compliance & Risk Management Tips for Smaller Financial Institutions

How to make smaller community banks and credit unions more efficient and effective, so they can compete with larger financial institutions.

A Momentous Day in American History, A Challenge for Mortgage Compliance and Risk Management

What mortgage lenders impacted by the new federal holiday, Juneteenth, need to be thinking about for business continuity and vendor management.

2021’s Hottest Risk Management Trends

Is risk management at your financial institution keeping up with the times? Find out here.

Ask the Auditors: Top Takeaways about Internal Auditing for Compliance and Risk Management

Top auditors discuss topics in compliance and risk management, including independence, examiners, and findings management.

Ncontracts Names Rafael DeLeon SVP of Industry Engagement

Ncontracts Names Rafael DeLeon SVP of Industry Engagement

Six Common IT Exam Issues—and the Controls You Need to Address Them

The six most commons IT exam flaws, according to examiners

Missed Opportunities: How Compliance & Marketing Can Work Together to Increase Loan Volume & Reduce Lending Compliance Risk

When the compliance and marketing teams openly communicate, the result is more focused campaigns to increase loan volume and reduce potential problems.

5 Risk Management Failures of the Galactic Empire

What can Star Wars teach financial institutions about compliance and risk management?

Ask a Risk Manager: How Can Risk Management & Compliance Work Together?

How can risk management and compliance work together as partners at a financial institution?

4 Features FIs Should Look for in a Cybersecurity Assessment Solution

How strong are your financial institution’s cyber defenses? It’s a question that’s top of mind for everyone—and it doesn’t have a simple answer.

How to Lighten Your Vendor Management Workload

Here are the most effective ways to lighten your vendor management workload while still ensuring your vendors are properly managed.

Supervisory Highlights: What We Can Learn from Others to Avoid Getting in Trouble

Here're the top highlights to know more about the landscape, make changes to be uncriticised, and view your business. Read the article to know more.

6 Features Your FI Needs in a Risk Management Solution

Here are 6 features to identify, assess, mitigate, and monitor risk, through an effective enterprise risk management (ERM) solution.

How Should the 3 Lines of Defense Work in a Vendor Management Program?

The Three Lines of Defense helps banks, credit unions, mortgage companies and fintechs build and effectively manage the vendor management lifecycle

COVID-19 One Year Later: We Are All Risk Managers Now

This month marks one year since the WHO declared COVID-19 a pandemic and a new normal began. It’s also the year we all became risk managers.

Should Your Internal Auditor Be a Subject Matter Expert?

An internal auditor does not need to be a subject matter expert. They should be smart, independent, and a strategic thinker.

Reduce Risk in These 4 Key Areas by Using Board and Employee Portal Solutions

Here are four key areas where financial institutions can reduce risk by using board and employee portal solutions.

Managing Complaints: The Role of the Three Lines of Defense

An effective complaint management program should leverage all three lines of defense to effectively manage this important customer contact.

Brentwood-based Ncontracts buys QuestSoft Corporation

Brentwood-based software firm Ncontracts has purchased a California tech company.

All the Risk News That’s Fit to Print: Ncontracts’ Top 2020 Risk Management Blogs

We’ve gathered our most popular risk management blog articles—selected from over 150 written this year—to help inform your risk management efforts.

Lending Compliance: Building Up the Three Lines of Defense

A financial institution’s lending compliance management system must effectively guard the FI against unnecessary risk with these three lines of defense.

Weigh the Risk Before Cutting These Key Costs, OCC Says

OCC is warning banks to be careful when cutting funding for key control functions and processes.

Ncast Podcast Launches with Remote Exam & Cyber Risk Discussion with ABA’s Paul Benda

Today we’re excited to announce the launch of our new weekly podcast, the Ncast! The Ncast Podcast launches with Remote Exam & Cyber Risk Discussion

What does the 'M' in CAMELS stand for?

The M in CAMELS stands for management, who is responsible for setting and implementing the strategic decisions and plans that determine CAMELS rating.

Halloween Fun: Spook-tacular Risk, Compliance & Vendor Management Stories

We’ve put together a collection of our best Halloween-themed risk, compliance, and vendor management blog posts.

6 Essentials for Flawless Policy Management

Flawless policy management is essential as regulations, the operational environment, and your financial institution’s priorities shift.

How to Manage Cyber Risk Like a Boss

October is National Cybersecurity Awareness Month and it’s an annual reminder of how financial institutions—need to do their part to manage cyber risk.

3 Ways to Use Consumer Complaints to Manage Lending Compliance Risk

Here are three ways financial institutions can use consumer complaint management to reduce compliance risk when it comes to fair lending.

Citibank’s $400 Million ERM & Compliance Fine: 6 Lessons Learned

Not properly implementing enterprise risk management for financial institutions can result in unsound practices, penalities, and more.

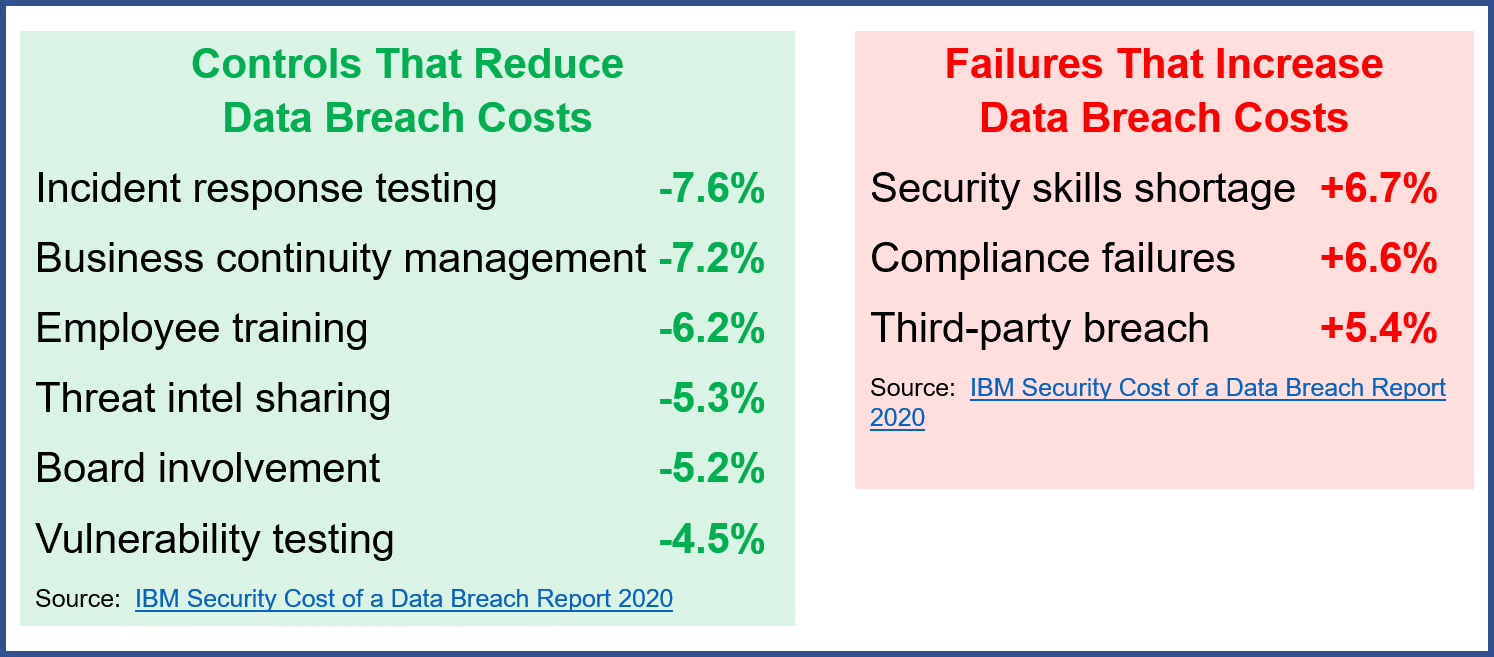

How to Reduce the Cost of a Data Security Breach at a Bank or Credit Union

Cyber risk management controls that reduce the risk of a data security breach occurring also reduce the cost of a data breach at banks and credit unions.