OCC Emphasizes Risk Management Lifecycles in 2025 Supervisory Priorities

The risk management life cycle is front and center for operational and compliance risk in the OCC’s 2025 supervisory priories for banks .

What is Dynamic Risk Management and How Does It Work?

Learn how dynamic risk management (DRM) can help financial institutions update risk assessments and address evolving compliance risks.

It's Not Too Late: 2022 Can Be the Year You Automate GRC!

Whether it’s governance, risk, or compliance (GRC), there are tools to help you organize, automate, and spark joy in 2022.

4 Reasons Gender Diversity Makes Your Board Stronger

Want less fraud, higher returns, and a more resilient financial institution? Include more women on your board.

Pivot! How to Build a Strategic Plan that Evolves With Your Financial Institution

Emerging technology, evolving consumer demands, and sudden market shifts have given new priority to pivoting for many financial institutions.

5 Ways to Increase Value and Relevance for your Community Bank

How can risk management help community banks stay relevant and strategic?

Board Members: Keep an Eye on Internal Controls

Conflicts of interest can lead to financial problems if board members don’t pay attention to risk management

Connecting the Dots Between Strategy, Mission & Risk

Risk management and strategic planning should support a financial institution’s mission, vision, and values.

5 Common Misconceptions About SOC Reports and How to Avoid Them

Financial institutions can reduce cyber risk with third-party vendor SOC reports, but only if you avoid these 5 misconceptions.

Ncontracts' Founder and CEO Michael Berman Publishes New Book, The Upside of Risk

Company proud to announce founder and CEO publishes new book, The Upside of Risk: Turning Complex Burdens into Strategic Advantages for...

Ncontracts Again Recognized by Inc. Magazine as One of America’s Fastest Growing Companies

Leader in compliance and risk solutions recognized by Inc. Magazine for the third year in a row.

A Change Management Reminder Courtesy of New, Temporary Mortgage Servicing Change

Keeping up with compliance change management means that mortgage lenders need to work smarter, not harder.

7 Must-Have Features in a Board Portal Solution

What financial institutions should look for in a board portal solution.

7 Ways to Make Your Next Meeting More Strategic

A few more minutes of prep can help you host meetings that focus on accomplishing your goals. Read on for 7 ways to make your next meeting more strategic.

10 Must-Have Elements to Include When Drafting Policies

When drafting policies, be sure to include these 10 must-have elements in each one to keep them effective.

4 Ways To Streamline Your CMS

Many institutions already have a strong compliance management system (CMS) in place.

7 Best Practices for Aligning Fintech With Your Business Strategy

Fintech is one of the buzziest trends in financial services right now, and no financial institution wants to be left behind.

The #1 Obstacle Between Your FI and Strategic Success

The biggest obstacle to strategic success is failing to understand risk.

Lessons Learned from Giving Away 1,100 T-Shirts at an ABA Conference

We handed out our full inventory of 1,100 free t-shirts at the ABA Compliance Conference earlier this month! Here's what we learned:

10 Tips to Make the Most of Your Next Banking Conference

Learn 10 best practices to help you make the most of your next banking industry event! These guidelines will ensure your next conferences is a success.

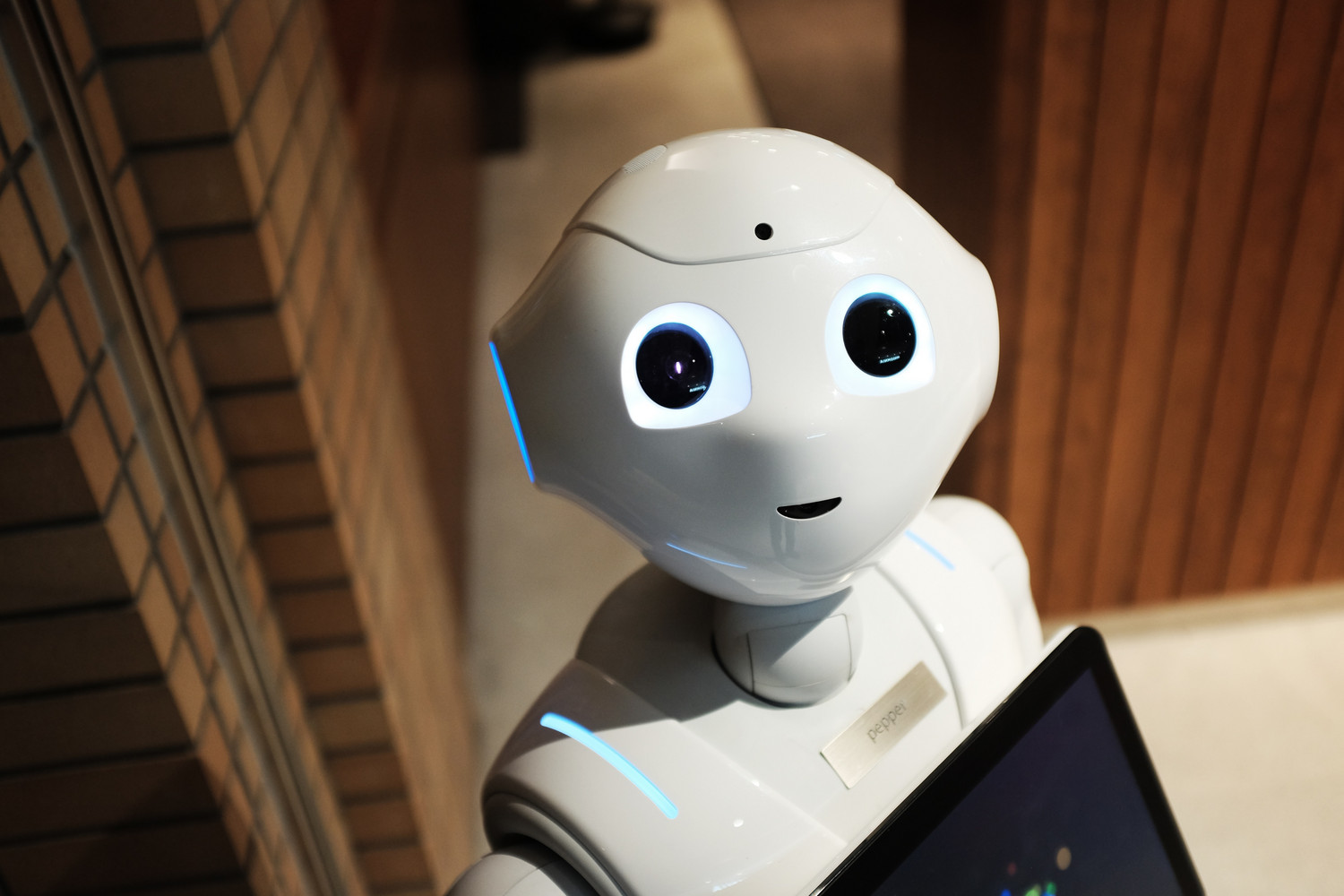

The Future of Finance: 5 Banking Trends to Watch

We’re highlighting 5 new banking trends that we believe will shape the future of banking and finance sectors.

5 Strategies for Any Financial Institution's Social Media Success

Learn tips on how to better manage your social media, whether you’re one person with a million other things to do or a full-time marketer at a bank.

Federal Reserve Definition

The Federal Reserve, also called the Fed, is the central banking system of the U.S., and the Federal Reserve Bank definition is any one of the 12 regiona

Continuity Of Operations Planning

Continuity of Operations Planning (COOP) is an effort taken within individual executive departments and agencies to ensure essential functions continue

Strategic Planning Processes

Strategic planning processes in a financial institution begin when a bank forms and continue as long as the bank is in operation.

5 Ways Intelligent Branch Planning Can Save Your Bank Millions

Here are 5 clear ways that intelligent branch planning can save your bank or credit union millions of dollars, with the numbers to prove it.

12 Tips to Help You Ace Your Next Board Meeting Presentation

In this post, you'll learn 12 tips to lead a rock-star Board of Directors meeting, and leave a positive impression on the leaders of your bank...

7 Ideas for Being a Better Negotiator with Your Team, Boss, and Board

In this post, the first in our Beyond Banking series, we'll be talking about some of the more personal aspects of banking. Whether you're...

7 Time Management Hacks for Super-Busy Compliance Professionals

Compliance officers deal with lots of work-related stress. Use these 7 time-management hacks to be more productive and reduce stress!