Risk Performance Management Software

Ncontracts’ powerful suite combines risk, compliance, vendor, and findings management solutions to drive efficiency and build a risk management culture resulting in smarter, faster decisions.

Average Increase in Efficiency

with Ncontracts time-saving software & solutions

of the American Banker Top 200 Community Banks

trust Ncontracts for their risk, compliance, and engagement needs

Improved Risk & Compliance Culture

experienced among clients using the RPM suite

What is risk performance management software suite?

The Ncontracts risk performance management (RPM) suite is made up of

four software solutions specifically designed for the financial services industry.

Nrisk

The adaptive ERM platform is designed for the future. Tailored to your institution's specific risk and control landscape, it grows with you, turning complexity into a strategic advantage.

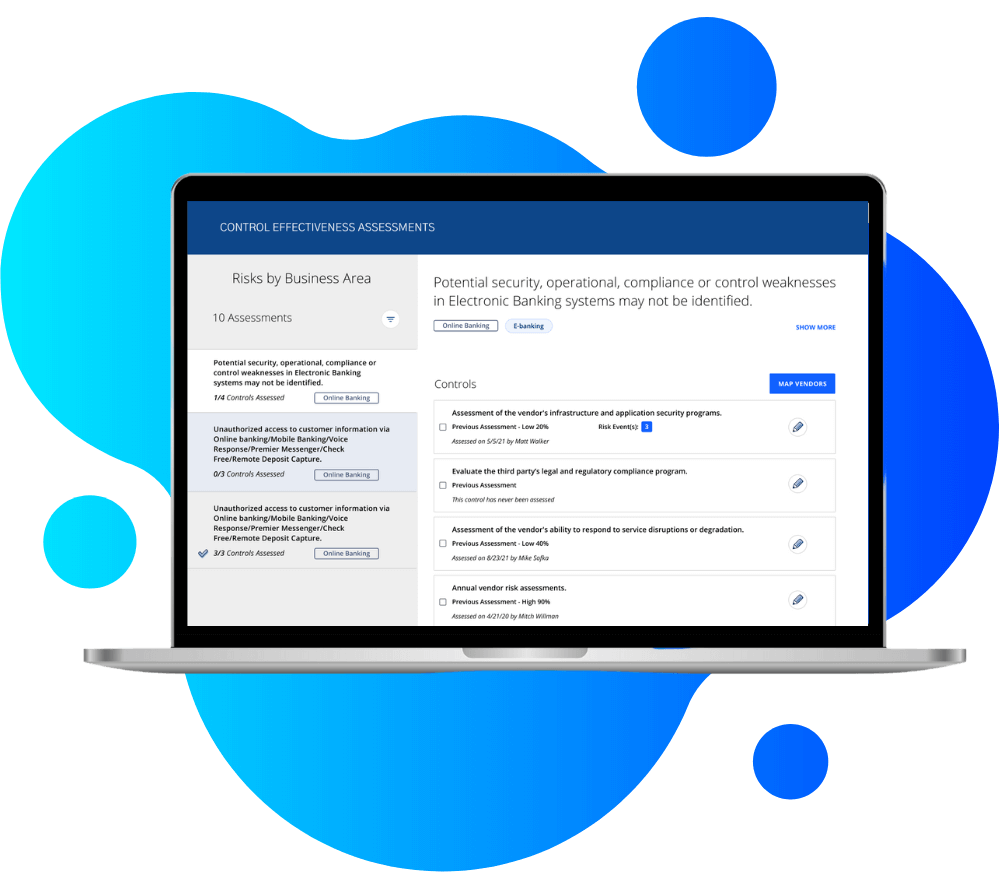

Nvendor

Drive growth and mitigate risks effectively with Nvendor, our comprehensive third-party risk management software. Uncover invaluable insights into your vendors and gain a competitive edge in the financial sector.

.png?width=750&height=560&name=4%20(1).png)

Ncomply

Ncomply increases your compliance team’s visibility into new and changing regulations, empowers them to be change agents, and consolidates much of the Compliance Management System functionality under one roof.

.png?width=750&height=677&name=Products%20Page%20Graphics%20NComply%20(1).png)

Nfindings

Upgrade your integrated risk management process by automating the complex findings process and gain visibility into exam and audit findings, so you can address issues right away.

.png?width=750&height=683&name=Cyber%20Monitoring%20copy%20(1).png)

See how Ncontracts RPM suite helped a financial institution like yours save thousands of professional hours each year, avoid costly and unnecessary headaches, and convert risk into a competitive advantage.

How Ncontracts RPM suite helps institutions like yours

Actionable insights for successfully navigating everything from digital disruption and economic uncertainty to regulatory change and staffing challenges

Expert knowledge, without the headcount

Regularly updated content — everything from model risk assessments to plain-English analysis of regulations.

Improve efficiency, effectively

RPM aligns the first, second, and third lines of defense, ensuring everyone speaks the same risk language.

Get to market even faster

The RPM suite has the tools and insights like GRC solution to help you answer your regulatory and risk questions for timely decision-making.

Adapt to changing circumstances

The RPM suite helps you set and measure KPIs to help assess your progress and make adjustments as needed.

Build a stronger risk management culture

The RPM suite empowers employees at all levels to manage and report on risk for a culture that is more risk aware.

The Enterprise Risk Management Buyer's Guide

In this enterprise risk management buyer’s guide, you’ll discover how centralizing and systematizing your risk management processes from governance to reporting protects your organization from emerging threats and positions it to claim developing opportunities.

%20(1).png?width=800&height=652&name=Copy%20of%20Various%20Clients%20%20Social%20Images%20(7)%20(1).png)

Integrated Risk Management 101: What and Why?

When key stakeholders and decision-makers don’t have a clear line of sight into risk, it’s easy to fall short of strategic goals, milestones, and policy objectives. Integrated risk management offers institutions a solution to this problem.

$6+ Billion Credit Union Case Study

With major growth plans in the works, the credit union’s board and management knew risk management was critical to understanding the path forward. Learn how the Ncontracts RPM suite helped.

Ncontracts Announces Launch of RPM Suite

Ncontracts, the leading provider of integrated compliance and risk management solutions to the financial industry, is helping to define a new category and view of risk management.