Fair Lending Software, HMDA, CRA & 1071

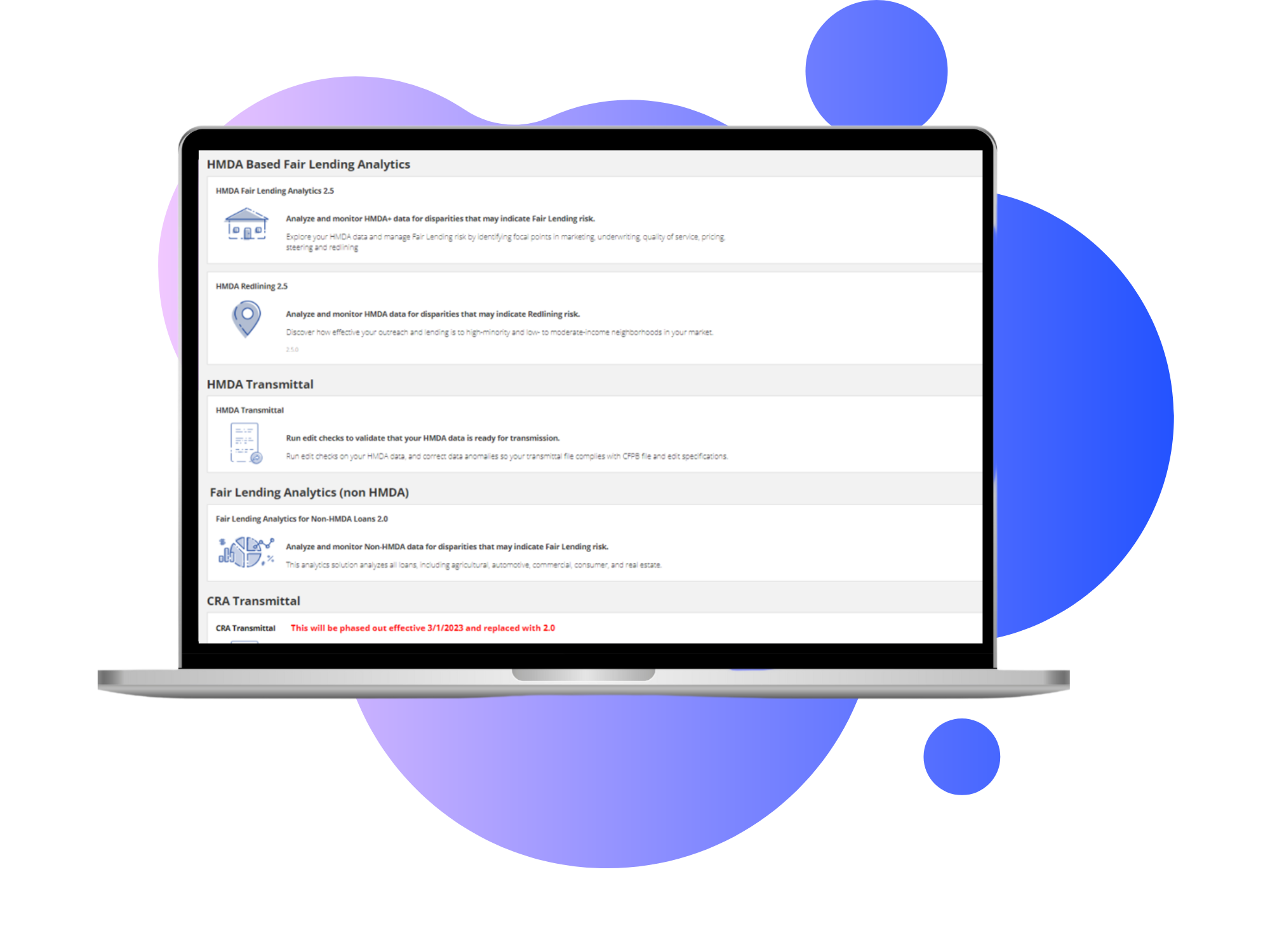

You’ve got loads of lending data – mortgage, consumer, and small business. Let Ncontracts help you manage and analyze that data with our web-based fair lending compliance platform that simplifies the entire process. Scrub and transmit data to regulators, and then analyze it for potential HMDA, Fair Lending, Redlining, CRA and 1071 risk.

HMDA, fair lending, redlining and CRA risk management software trusted by financial institutions from coast to coast

Tools for Mastering Lending Compliance

Nlending gives lenders the compliance management tools they need to help ensure compliance with data reporting for HMDA, CRA and 1071. From data scrubbing and transmittal to sophisticated analytics and expert support, our fair lending program has lenders covered – whether you are a lending compliance beginner or a seasoned pro.

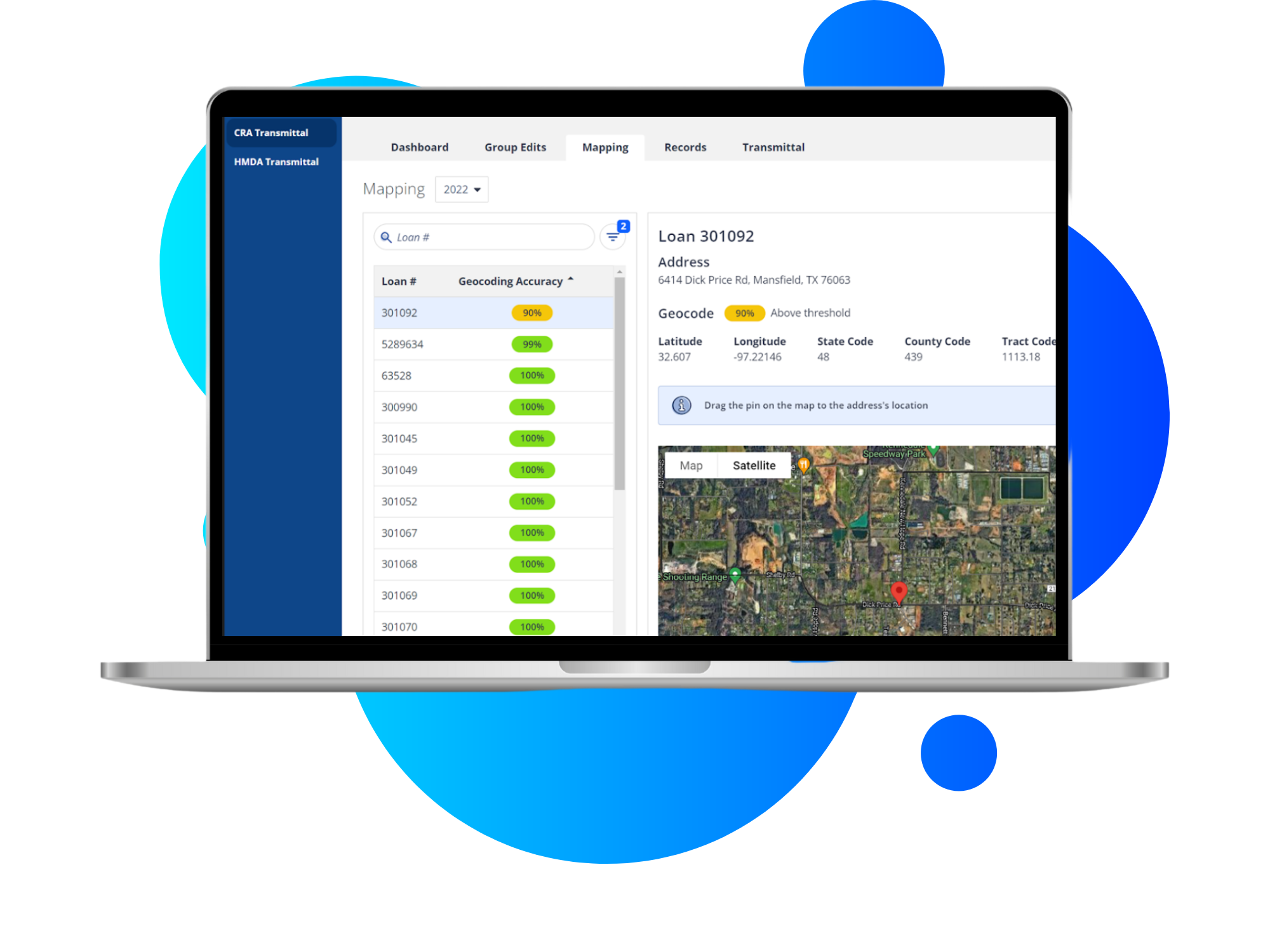

Mapping and Geocoding

Batch, single search, or integrated LOS geocode for the highest available level of street matching (99.5%) with GPS quality street data. Analyze applications, loans and deposits via interactive mapping (includes tract income and minority, roadways, census tracts, zip codes, etc.)

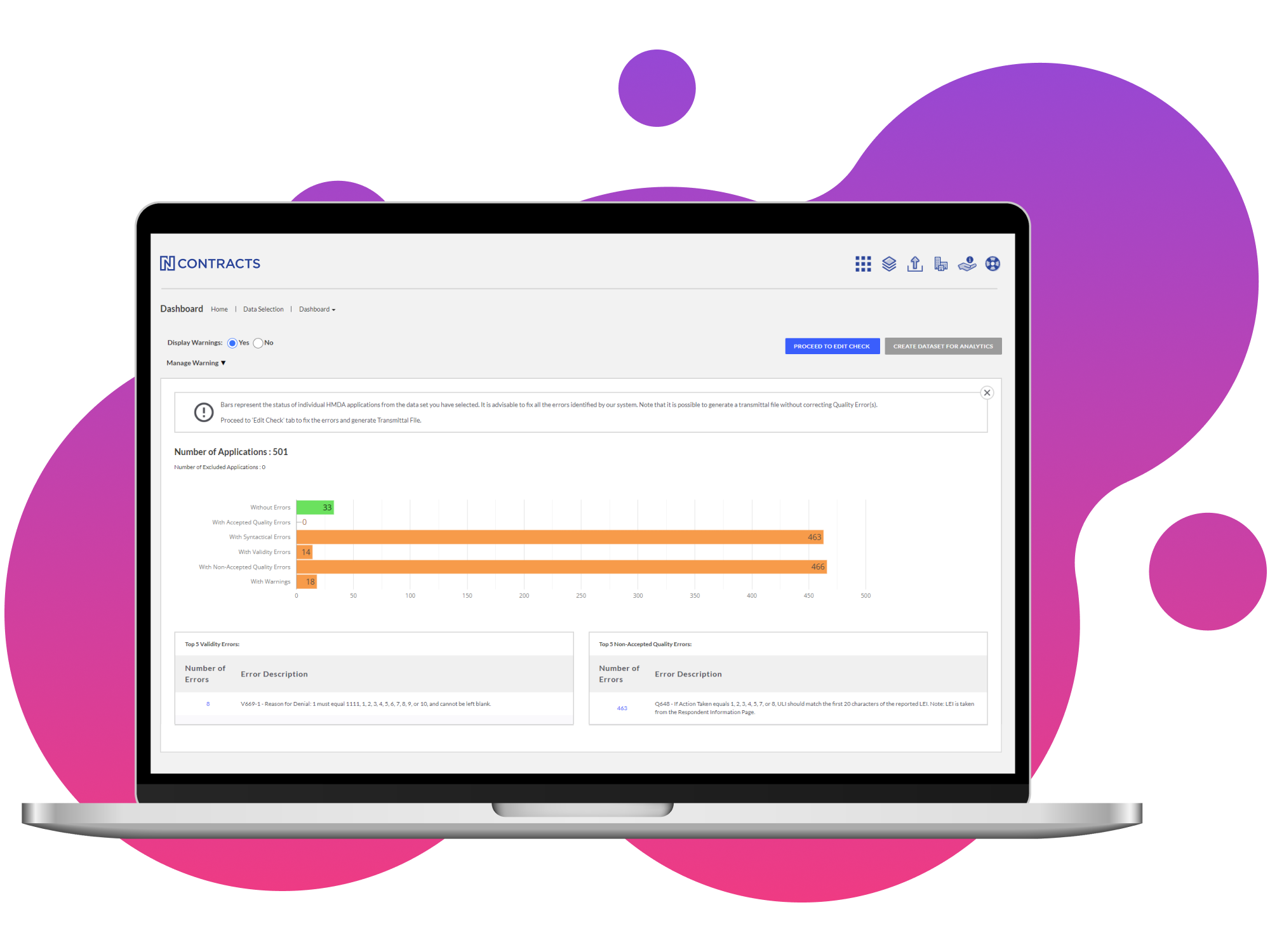

Error Identification

Dozens of data fields make combing through HMDA, CRA, and 1071 LARs to identify discrepancies time consuming and tedious. Our fair lending compliance software identifies potential data errors – such as geocoding that doesn’t match or an address doesn’t exist – and allows lenders to correct them prior to submission.

Exam-Ready Reporting

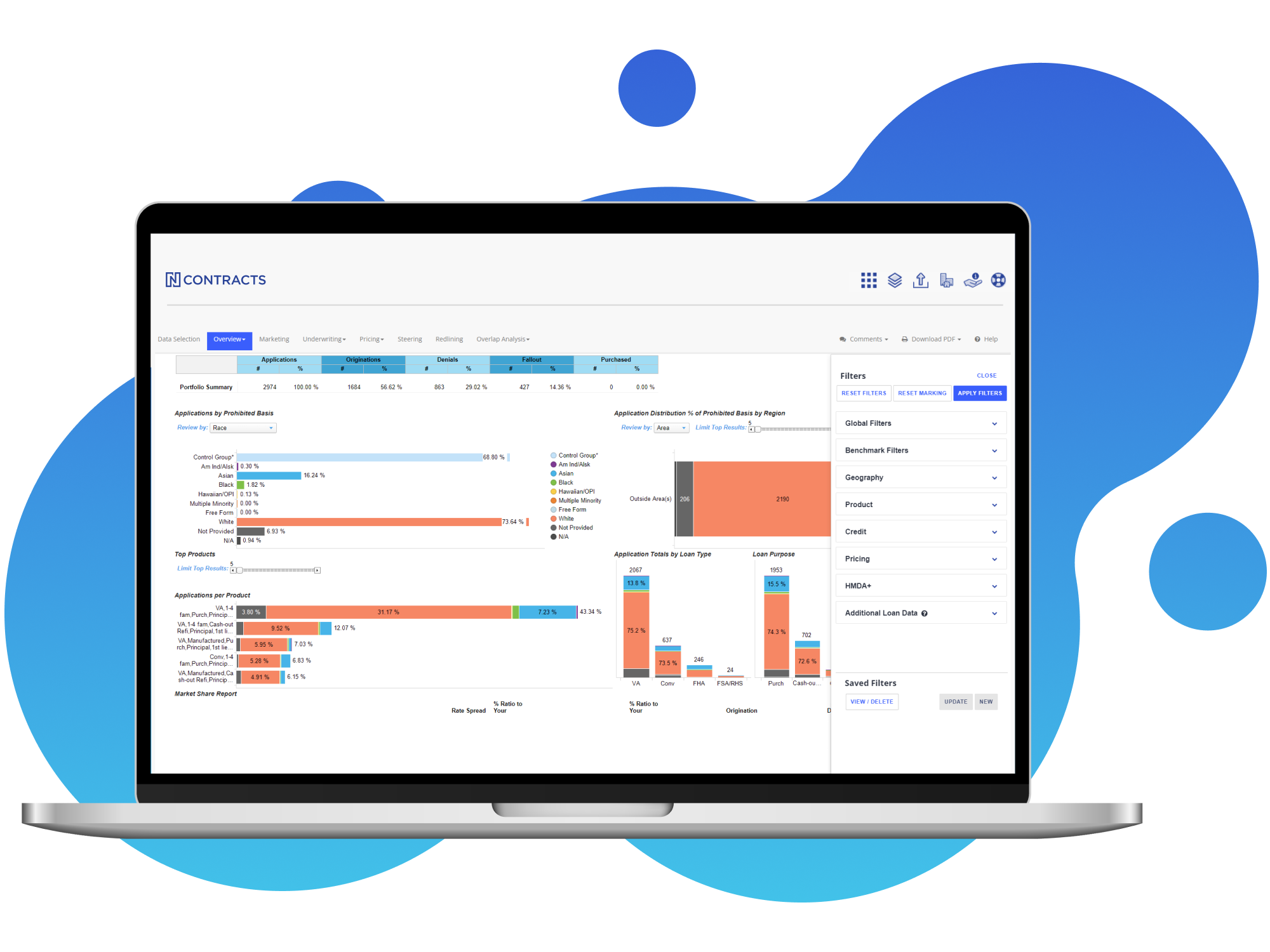

Pre-built reporting templates quickly generate management-ready reports, including parity to peer, redlining and lending decision reports plus data analysis and matched pair reports. Choose from a flexible selection of presentation formats such as charts, mapping and color-coded data visualization.

-1.png?width=2000&height=1500&name=Exam-Ready%20Reporting_Graphic%20(1)-1.png)

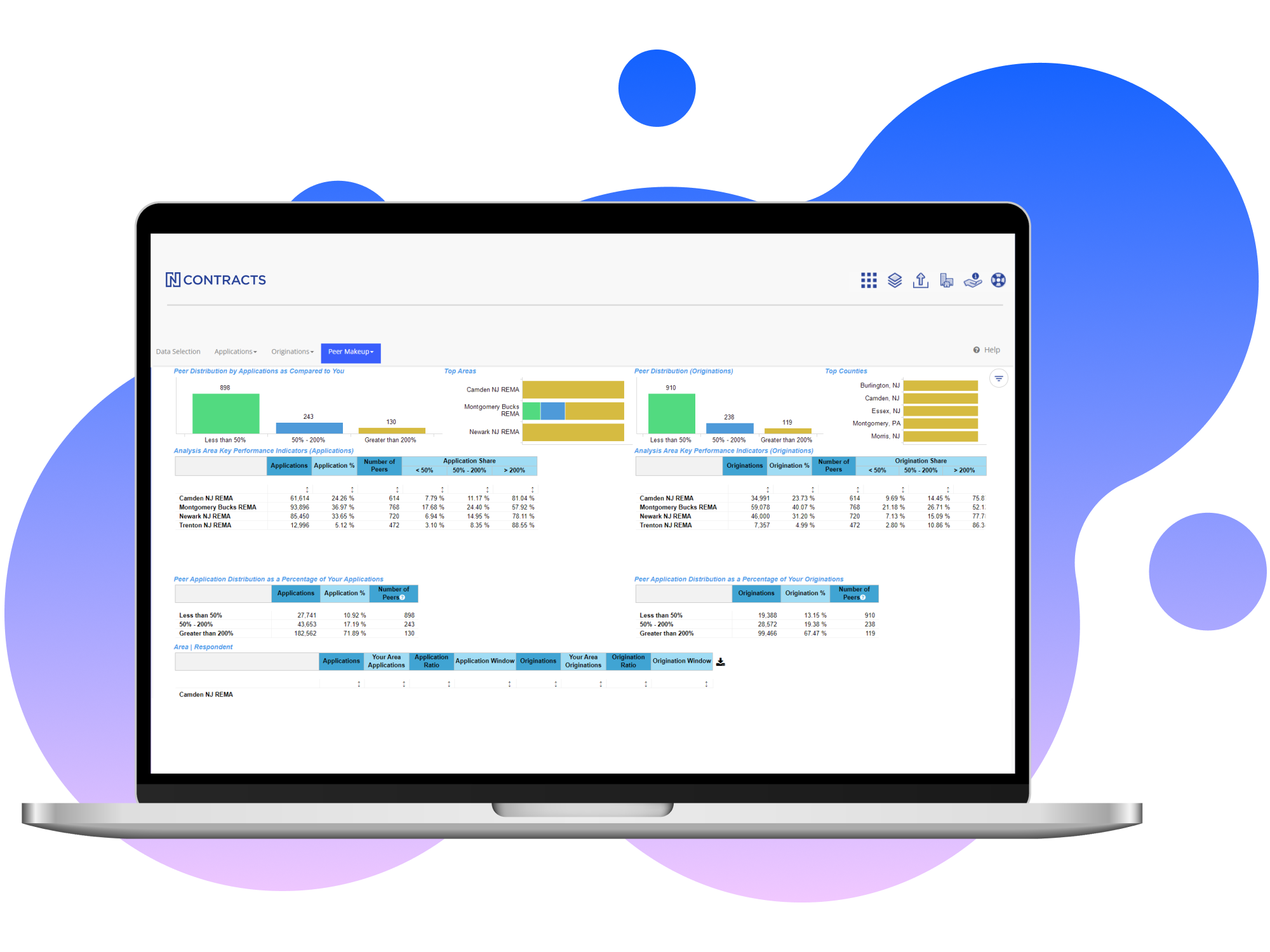

Peer Benchmark Analysis

Benchmark analysis enables you to compare your lending to peer institutions in your analysis and/or assessment area REMA.

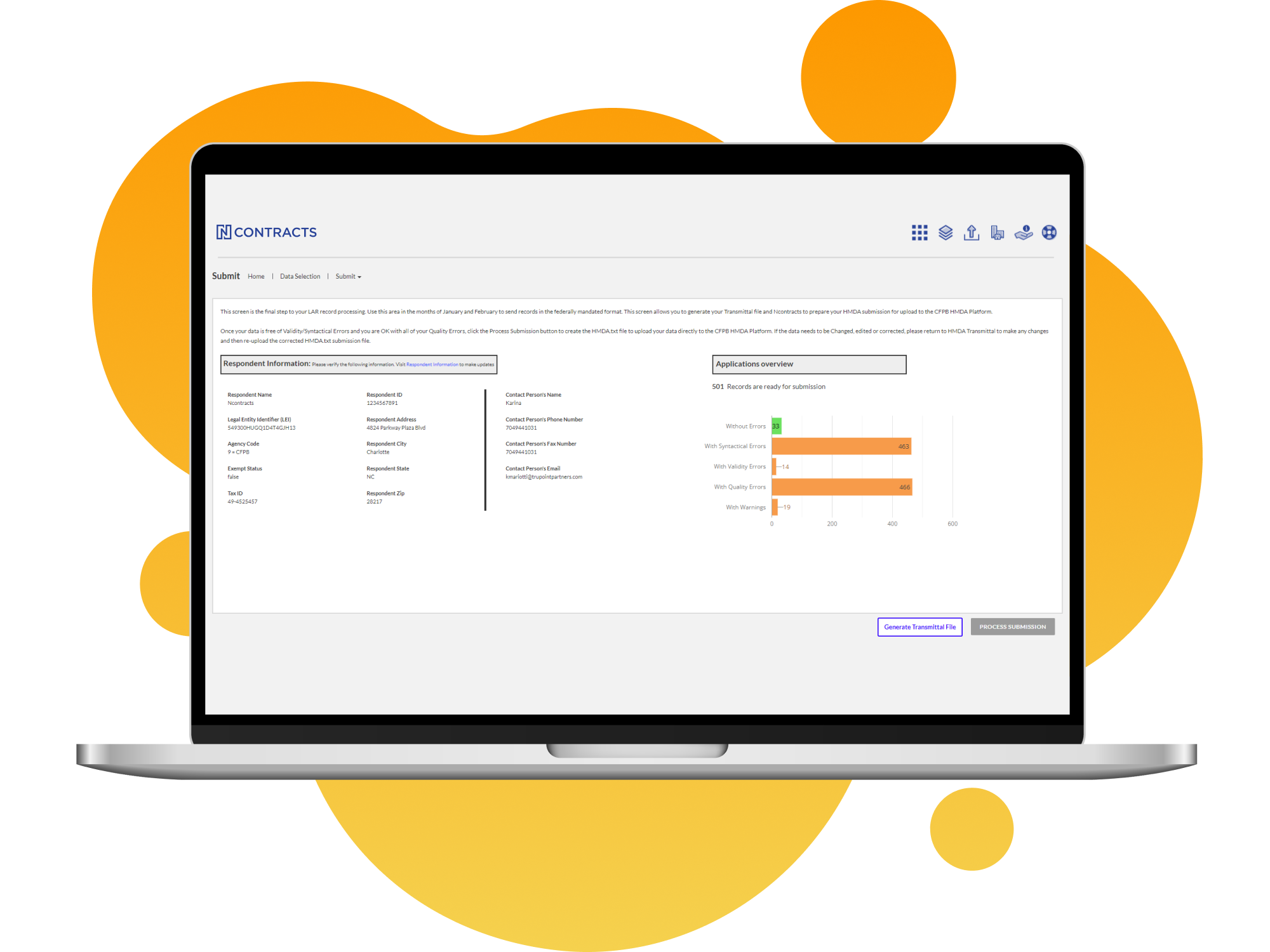

Lending Data Transmittal

Format and file applications and loans in compliance with regulatory requirements. Capture application and loan data for transmittal files.

Interactive Data Visualization

Interactive results panels permit users to adjust parameters, make notations, and interact with the data.

Sophisticated Lending Analytics

Analyze your data by applying filters to narrow results and identify emerging risks. Perform comparative reviews, highlight disparities, and select matched pairs and target and control groups.

Single sign on (SSO) access and dashboard interface

Administrative control of authorizations and access levels

Proxy assignment methodology for consumer lending analysis

Ability to import a variety of data via data mapping tool

Pre-loaded market data (Census, HMDA and CRA)

In-app storage and access to individual loan records

Notation recording capabilities

Automated geocoding

Expert guidance

Redlining, HMDA, CRA, 1071 & Fair Lending Software Solutions You Need

Powerful 1071, CRA, HMDA, and Fair Lending Software

Your lending program is the heart of your business. Give it the attention it requires without weighing down your staff. Our fair lending risk assessment software is the user-friendly, expert-backed lending compliance solution your institution needs.

Cleaner Loan Data, Faster

Our CRA, HMDA and 1071 software solutions save staff time by identifying potential lending data errors and helping correct them prior to submission to regulators. The system quickly processes application and loan data for clean data that meets regulatory requirements.

Better Understand Your Lending Footprint

Our solutions enables you to sort, map, and geocode applications quickly to help you identify potential issues. Filter by demographics, loan characteristics, and other fields and turn raw data into actionable insights. Conduct peer analysis to compare your performance to other lenders in your areas.

Simplify Lending Data Analysis

You don’t need a PhD in math or statistics to understand your data with Nlending. Our software makes quick work of time-consuming and complicated analysis so you can identify and remediate fair lending compliance risk in key areas, such as marketing, underwriting, pricing, steering, redlining, and matched pairs.

Ensure Exam Readiness

Confidently answer examiner questions about your loan data and explain any disparities. The proof is in the data analysis and exam-ready reports.

Present Compelling Narratives

Ncontracts’ in-house lending compliance experts leverage decades of experience to help your institution look beyond the numbers to truly understand its data and capture insights that identify regulatory issues and growth opportunities.

Uncovering Fair Lending Risk to Build a Stronger Fair Lending Program

Uncovering and preventing discriminatory lending practices is a must for every financial institution. Discover tips for analyzing fair lending compliance risk, implementing the right controls, and building a culture of fair lending compliance at a time of heightened regulatory scrutiny. See our fair lending software in action.

%20(1).png?width=1000&height=809&name=Copy%20of%20Various%20Clients%20%20Social%20Images%20(6)%20(1).png)

Fair Lending 2024: Top 7 Takeaways

What do you need to know about fair lending compliance in 2024? That’s the question we answered in our webinar.

The Fair Lending Analytics Buyer’s Guide

Learn about the key components to look for in a modern fair lending analytics solution.

7 Essential Fair Lending Risks

Fair Lending compliance can be complex - but a clear understanding of your risk can make it much simpler.